A deeper dive into alternative protein investments in 2022: The case for optimism

1,651 words | 7-minute read

Long-term investor appetite for alternative proteins remains strong despite challenging market conditions slowing investment growth in 2022

“While the economy has slowed down, innovation continues to accelerate in the alternative protein sector. Companies that start during this economic downturn will build efficient operations and have a running start as the economy improves again. Historically, some of the best companies have been started during difficult economic times…”

Guatam Godhwani, Founder and Managing Partner, Good Startup

Today, alternative proteins are a nascent category. Plant-based meat represents a little over one percent of the meat market in the U.S. and cultivated meat has not yet hit global markets. At this critical moment, investors are recognizing its growth potential.

Over the past decade, the alternative proteins sector has attracted $14.2 billion in private capital, with annual investments nearly doubling every year on average (though with high variance, which is standard for a young industry). Investments accelerated in recent years through 2021. They grew 53 percent from $719 million in 2018 to $1.1 billion in 2019, the year Beyond Meat experienced its record-setting IPO and drew significant media attention to the sector. Buoyed by a slew of new products and innovations coming to market, alternative protein investments almost tripled to $3.2 billion in 2020 before surging to a record $5.1 billion in 2021—a time of broad investor exuberance, with record-breaking venture funding across most sectors.

New GFI analysis of Pitchbook data shows that alternative protein companies raised $2.9 billion globally in 2022, a decrease of 42 percent year-over-year that returned funding to pre-2021 levels.

Although overall alternative protein investment declined in 2022, investments grew meaningfully in some regions, as investor diversified their holdings. Companies based in APAC saw 43-percent year-over-year funding growth to reach $562 million in 2022, while in Europe, investments grew 24 percent year-over-year to reach $622 million.

Alternative proteins are still a small sector in which a handful of raises determine annual investment figures; in 2022, the top ten disclosed deals (of 311 in total) accounted for 47 percent of total deal value. As a result, it can be difficult to draw conclusions from annual variations in funding. However, it appears that the deceleration of alternative protein funding in 2022 was in line with broad funding declines as global private funding declined by 35 percent, while funding for fintech (a popular VC-funded sector) declined by 46 percent. This conclusion is reinforced by the results of a GFI investor survey, discussed further below, which indicates that investors who did slow their alternative protein investing in 2022 primarily did so due to broad market and economic conditions.

This funding slowdown occurred amid the largest losses for the key equity indices since the 2007-2008 financial crisis, including the MSCI World Index (-17.7%), the S&P 500 Index (-18.1%), and the growth-oriented Nasdaq Composite Index (-32.5%). More dramatically, the Pitchbook VC-backed IPO index fell by more than 60 percent. Much of this market turmoil was driven by the U.S. Federal Reserve rapidly raising rates to 4.25 percent, the highest benchmark interest rate in 15 years, in an attempt to tackle elevated inflation. Market sentiment was further dampened by acute climate events, an ongoing pandemic, and the invasion of Ukraine.

The outlook remains optimistic for alternative proteins

While some alternative protein companies have experienced challenges, others are succeeding in this competitive environment. Distribution has picked up for fermentation-enabled proteins – a number of companies launched products for the first time in 2022. UPSIDE Foods earned a green light from the FDA for its cultivated chicken, a de-risking event that could impact future investment activity in cultivated meat. Several large food companies launched plant-based versions of long-branded food products. And quick-service restaurant chains experienced a resurgence in plant-based menu launches as consumers returned to foodservice after the unprecedented shift to retail in 2020 driven by the pandemic.

The world’s largest protein producers are also increasingly involved in the industry: of the 60 largest global meat, dairy, and seafood companies tracked in the The Coller FAIRR Protein Producer Index, half are investing in the alternative protein market as of 2022, more than double the amount in 2019.

Moreover, large food companies see protein diversification as a material business issue; according to FAIRR, 35% of the 23 largest food manufacturers and retailers globally have committed to increasing the volume or sales of meat alternatives and/or dairy alternatives, up from 28% in 2021.

The current fundraising market may improve the quality of opportunities for startups and investors alike. Startups will see an alleviation of pressure to “grow at all costs,” and can instead hyper-focus on product quality. Meanwhile, investors can find themselves with more time to explore and research deals, and with more favorable valuations and deal terms.

New GFI analysis supports the notion that investor appetite for alternative proteins remains strong. Our survey of more than 100 investors active or interested in alternative proteins found that:

- 99 percent of respondents agreed or strongly agreed with the statement “I am optimistic about the alternative protein industry over the long term.”

- 45 percent of respondents noted that their investments in alternative proteins did not slow down in 2022.

- 87 percent of respondents expected to make investments in alternative protein companies or funds in 2023.

- Most respondents expect to increase investment in the more novel alternative protein categories, especially fermentation, cultivated dairy, and alternative fats.

- Respondents expect to increase investment in B2B/ingredients and equipment business models, a key need for the sector to scale.

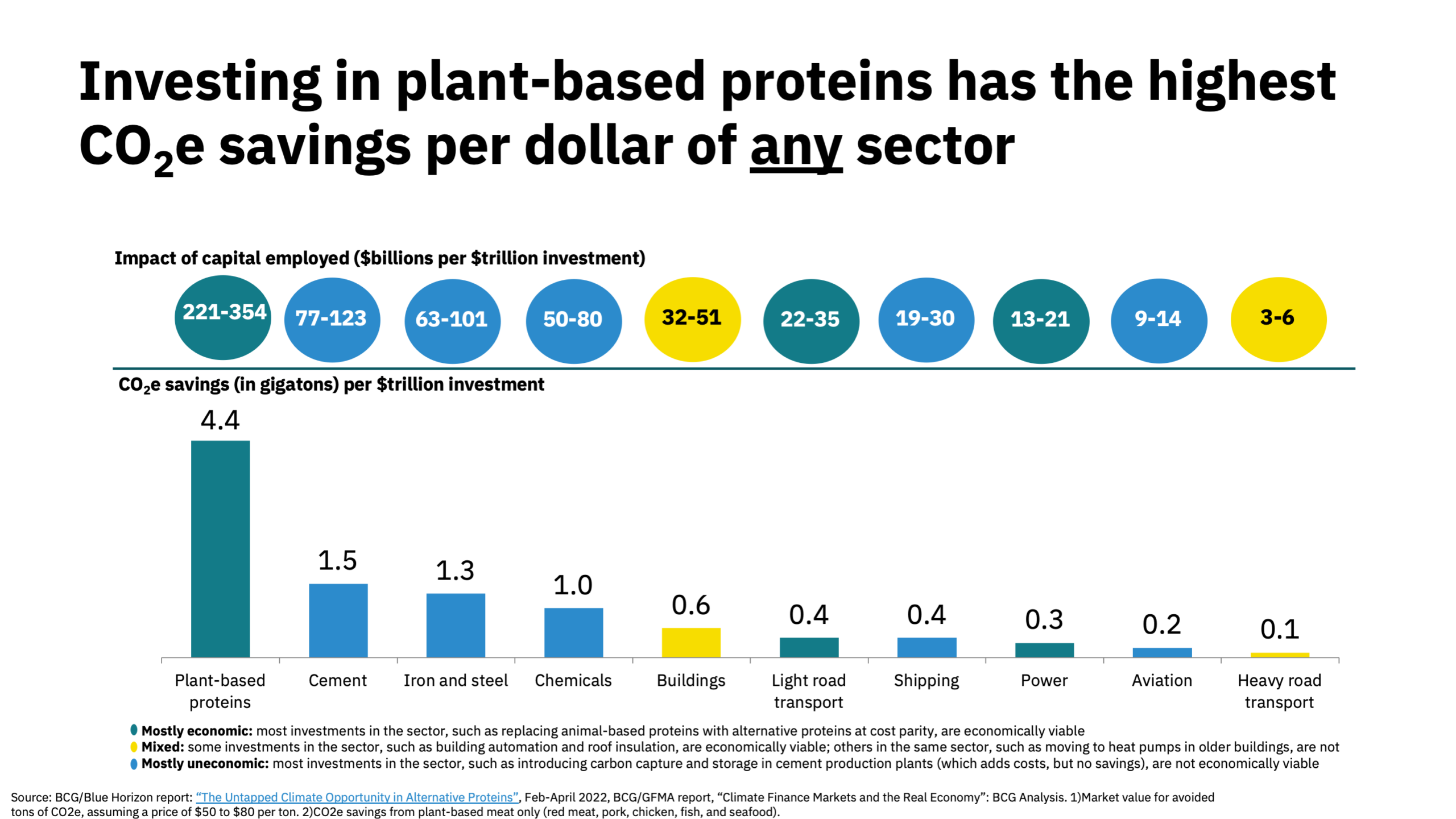

Investing in plant-based proteins has the highest CO2e savings per dollar of any sector

The alternative protein sector may be small right now, but its growth is essential to combating climate change and biodiversity loss. Replacing conventional animal-based meat with plant-based meat can reduce greenhouse gas emissions by 90 percent, while using 99 percent less land and water. Doing the same with cultivated meat can cut emissions by 92 percent, and use up to 95 percent less land and 78 percent less water.

Alternative proteins provide the biggest bang for their buck of any climate mitigation technology. A report by the Boston Consulting Group (BCG) and Blue Horizon compared the emissions reduction potential of ten climate mitigation sectors and found that investment in plant-based proteins saved the most CO2-equivalent emissions of any sector by far, with three times the impact of the next best sector.

Source: BCG/Blue Horizon report: “The Untapped Climate Opportunity in Alternative Proteins”, Feb-April 2022, BCG/GFMA report, “Climate Finance Markets and the Real Economy”: BCG Analysis. 1) Market value for avoided tons of CO2e, assuming a price of $50 to $80 per ton. 2)CO2e savings from plant-based meat only (red meat, pork, chicken, fish, and seafood).

Despite large emissions savings and market growth potential, alternative proteins are underfunded as a climate solution. A report by the Rockefeller Foundation and BCG estimates that alternative proteins have an annual unmet funding need of $40 billion. Clearly, there is ample room for new investors to enter the space, and for existing ones to double down on their commitment.

Alternative proteins’ status as an increasingly important ESG industry can provide upside for investors and the industry during this funding downturn. ESG is a significant driver of investor interest, selected as having “very important” or “critical” impact on investment decision-making for 72 percent of investors surveyed. Moreover, a plurality of investors (42 percent) noted that ESG and impact were their primary drivers of interest in alternative proteins.

ESG-oriented investors have quite a bit of capital to put to work. As of September 2022, PitchBook estimates that private impact funds have $113 billion in dry powder (funds that have yet to be invested). Now is the perfect time for ESG-oriented investors to lean into the alternative protein industry, especially as market downturns can often lead to attractive investment opportunities.

So while deal-making has slowed and may remain subdued for some time, it’s important to keep sight of the bigger picture. The startups best-positioned for success will still be able to raise capital, new investors may be attracted to the sector, and ESG-oriented investors will find companies to advance their double (or triple) bottom line.

Governments have an increasingly critical role to play

When private markets slow down, public funding can often pick up the slack. Public investments in alternative proteins have steadily increased over the past several years. A number of countries have made notable investments or commitments to funding alternative proteins including the United States, China, Denmark, Israel, Singapore, and Canada. Through the end of 2021, all-time global public alternative protein R&D funding totaled about $360 million.

While global public investment in alternative proteins is growing, it is a drop in the bucket compared to other public climate investments. For example, global governments committed $500 billion to renewable energy development in 2022. The United States alone committed $7.5 billion last year to build a national networking of electric vehicle charging stations. To realize a sustainable, secure, and equitable protein production system, governments must increase their commitments to alternative proteins, and the current market provides an opportunity to do so.

“High-quality companies will be able to raise capital, while those with less sure footing may struggle, ultimately leading to a healthier industry. The good companies will definitely get the capital. The noise will go away, the clutter will go away. Consumers will not get 25 different burger options (hopefully), they will get the ones that will make a difference.”

Sagar Bhadra, Director, Temasek, at Future Food-Tech: Alternative Proteins

We expect the alternative protein industry to continue to evolve and grow as governments fund research and infrastructure, investors double down, companies continue to innovate, and more high-quality products—especially “hybrids”, leveraging ingredients made from cultivated meat or fermentation—are introduced to consumers.

“The silver lining of this market environment is that companies are priced correctly and have longer runways. Now is the time to lean in.”

Shayna Harris, Co-Founder and Managing Partner, Supply Change Capital, at the Bank of America Alternative Proteins Conference

We’re in the early days of a game-changing industry, during one of the most unusual market environments of our lifetimes. The road ahead will be challenging and complex, but from our estimation, the good food future is bright.

Page

Investment

Connect with startups who are fundraising. Learn about the market and technical landscape for plant-based meat, cultivated meat, and fermentation.