Advancing solutions for alternative proteins

Explore commercial whitespaces, research gaps, technological needs, and investment priorities at each stage of the alt protein value chain.

Introducing our solutions work

In order to accelerate alternative proteins as quickly and efficiently as possible, we identify existing and future bottlenecks as well as promising solutions for the field’s most pressing challenges.

In our work to advance solutions for alternative proteins, we conducted extensive research, a market-shaping analysis, whitespace ideation, and interviews with more than 150 experts across the alternative protein field. We’ve packaged our findings into our Solutions Database, a list of innovation priorities, and a series of reports.

As a nonprofit, we value sharing knowledge freely and generating open-access information that will benefit every innovator in this space. These resources will enable you to find concrete opportunities to get involved with—and accelerate—the vital transformation of our food system. As you’ll see, there are many ways to be a part of feeding our growing population in a secure, sustainable, and just way.

Explore our Solutions Database

Discover commercial whitespaces, research gaps, technological needs, and investment priorities at each stage of the alternative protein value chain.

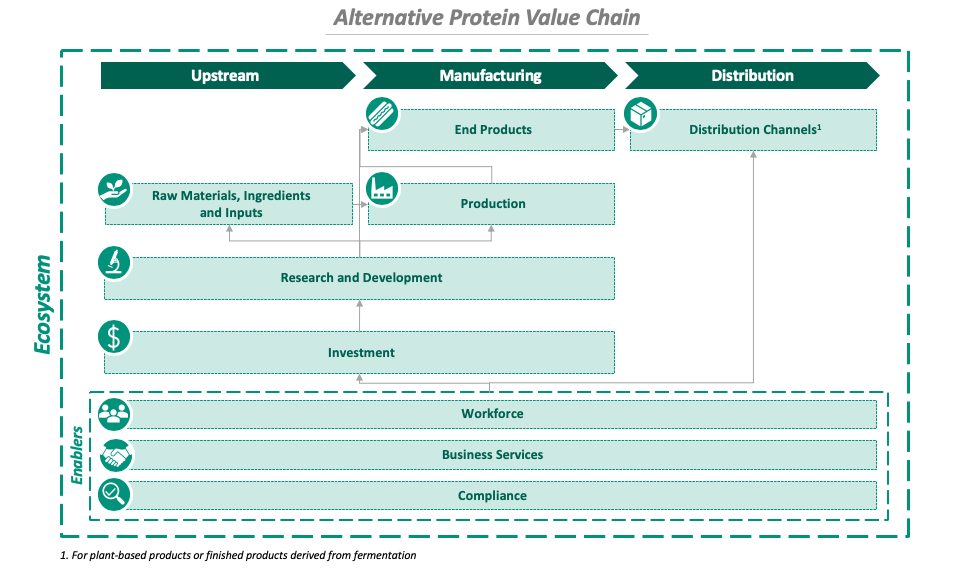

How we segment the alt protein value chain

We map innovation priority areas and solutions to specific segments within the alternative protein value chain.

Innovation priorities

Achieving success in the alternative protein field requires bold innovation across the entire value chain. Learn about key challenges and potential solutions in each part of the value chain based on GFI’s research and hundreds of conversations with experts from industry, governments, NGOs, and academia.

End product innovation priorities

Finished product formulation needs to match consumer preferences in many areas, particularly sensory attributes—taste, texture, appearance, and aroma—as well as price, nutrition, sustainability, variety, and familiarity.

Plant-based end product priorities

Some plant-based products exhibit a lack of versatility: consumers will often use animal proteins such as chicken in dozens of different ways, while plant-based products are often formulated for highly-specific applications, such as nuggets. Plant-based products that are convenient to purchase, transport, store, prepare, cook, and seamlessly integrate into common recipes and cuisines are needed.

Cultivated end product priorities

The cost of producing cultivated meat is a foremost challenge in the field. Vast reductions in unit price will require both technologic advances and economies of scale, which we enumerate in detail throughout this page.

Nutritional equivalence to animal products

Achieving and demonstrating nutritional equivalence to animal products will be a key milestone for cultivated meat. Replicating the precise levels of nutrient accumulation that occur within animal tissue is not trivial, but there is greater opportunity to exquisitely fine-tune the resulting product’s nutritional profile using customized media than by modulating an animal’s feed.

Demonstrating sustainability advantages

It will be incumbent to demonstrate the environmental and sustainability benefits of cultivated meat before production is at commercial scale. Conducting rigorous life cycle assessments will be critical, and these analyses should be sure to note the potential for increased efficiencies across all stages of the plant, fermentation, and cellular agriculture life cycles, as well as the opportunities for increased efficiency that come with scaling up production.

Key end product solutions

Read more about our proposed end product solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

Research & development innovation priorities

Key R&D related activities include prioritizing among unanswered research questions, enacting government and private-sector funding for research, and conducting public- and private-sector R&D. Please visit GFI’s Research Grant Program for additional information on key areas for innovation in the R&D of alternative proteins and a list of research grant projects addressing critical scientific challenges. If you are working on an R&D challenge in alternative proteins and haven’t already engaged GFI, let us know.

Plant-based R&D priorities

While plant-based protein is the most commercially mature of the three alternative protein production platforms, it is arguably much less developed in terms of basic R&D. This is in part because there are fewer cross-applicable projects in plant-based meat than in cultivated meat and fermentation, both of which are very advanced in other contexts. Thus, a host of high-priority R&D areas for innovation remain.

Breeding & engineering for higher protein yields and functionality

Breeding or engineering for higher protein yields and improved innate functionality would decrease reliance on downstream process steps. This would pave the way for cost reduction, greater sustainability, and increased interest in underutilized plant protein sources.

Protein fractionation and functionalization

Protein fractionation and functionalization (the process of isolating, identifying, and characterizing plant proteins, then preparing them for processing via extrusion or other texturization methods) are among many underexplored areas, especially for unconventional plant protein sources like specialty crops (e.g., lemna, hemp). These processes are critical for protein functionality and performance, and thus can make a huge impact on taste and texture.

Improved plant fat profiles

The fat profile of most plants is not ideal for recapitulating the properties of animal-based fats. Traditional oilseed crops could be modified to produce higher levels of fats that are desirable to plant-based formulators but are more difficult to source from plants, such as saturated fats, eicosapentaenoic acid (EPA), and docosahexaenoic acid (DHA).

Novel methods for texturizing and structuring plant-based proteins

Novel methods for texturizing and structuring plant-based proteins are needed to provide alternatives to extrusion (currently the predominant method for texturizing plant-based meats). Practitioners report that even small shifts to process (e.g., heat, moisture levels) or input variables can have exaggerated effects on extruded products, and thus the industry would benefit from production methods that are less sensitive and more robust. Extrusion alternative research is particularly well suited for academic R&D, with massive commercial potential upon technological validation.

Cultivated R&D priorities

The development and commercialization of cultivated meat at scale will require R&D innovations across multiple core technology areas, from cell line optimization and cost-effective media production to new scaffolding and bioreactor solutions. Click here for a more comprehensive discussion of R&D priorities in cultivated meat.

Bioreactors capable of supporting high-density, large-volume cell cultures

To scale beyond taste tests toward market readiness, standard 2D cultures or stirred flasks are not a viable option for large-scale growth and must be replaced by bioreactors capable of supporting high-density and large-volume cell cultures.

Cell growth surfaces

Many cell types used for cell-based meat are naturally anchorage dependent and must be cultured on microcarriers or another solid surface, though innovations in cell adaptation or editing can now facilitate suspension growth.

Characterized volatile compounds

A litany of volatile compounds, many of which differ by species type and cut, contribute to the taste of meat; these compounds should be more holistically explored and characterized.

Meat science expertise

To fully capture the meat-eating experience that consumers expect, the cultivated meat industry needs to draw upon the deep meat science expertise that exists in the conventional meat industry. There is a knowledge gap and a lack of standardization between the meat science field and the cultivated meat field with respect to analytical tools and key parameters for defining meat composition and quality.

Research & monitoring tools

Cultivated meat research can be accelerated across the board by the development of appropriate research tools and key data sets. A suite of assays, genomic data, contract research services, and commercially-available reagents exists for humans and commonly used laboratory species such as mice or fruit flies. However, the same species-specific research toolkit does not yet exist for most species used in cultivated meat, with an especially large gap — and, thus, opportunity — for seafood species.

While real-time, in-line monitoring techniques exist for cell culture processes, they have not been optimized for cultivated meat or fermentation-derived protein production processes. Broadly, there is a pressing need for the development of novel, scalable technologies that enable greater efficiency and effectiveness in the monitoring of end-to-end production processes.

Fermentation R&D priorities

Microbial fermentation is not a new technology. For decades, recombinant proteins have been produced at scale for pharmaceutical and industrial applications. The key question for the field of fermentation for alternative proteins is how best to improve the unit economics of production while expanding the menu of ingredients (e.g., Impossible Foods’ heme) to specifically address taste and texture requirements for meat, egg, and dairy products.

Increased titers and yields

To compete with animal-based proteins, researchers and companies must increase the titer (amount of an expressed target molecule relative to the volume of total upstream-produced liquid containing the agent; primary benchmark of upstream efficiency) and yield (the ratio of mass of final purified protein relative to its mass at the start of purification; primary benchmark of downstream efficiency) of target molecules and protein biomass.

Strain engineering

Strain engineering is a particularly promising avenue, and may also unlock the potential to use cheaper fermentation feedstocks, which would ultimately drive down production costs.

Safety studies and genetic tools for more microbes

Experts also suggest that safety studies and genetic tools for a wide range of microbes would increase innovation in host strain selection.

Lipid production

Fermentation-derived lipid production is relatively unexplored for food applications but has a fairly robust history for industrial chemicals. The alternative protein industry may be able to develop an open-access research foundation and accelerate the commercialization of fermentation-derived fats by aggregating lipid synthesis pathway insights from the chemicals industry.

Key R&D solutions

Read more about our proposed research & development solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

Production innovation priorities

Production innovation priorities include ideas for expanding and improving manufacturing capacity, infrastructure, equipment, methods of production, and downstream processing.

Plant-based production priorities

Production capacity demands for plant-based meat will be enormous if demand for end products soars. Designing novel equipment that can handle a wide variety of ingredients, process multiple finished products, and perform at scale is an important area for innovation.

Extrusion innovation

While extrusion is a well-known and traditionally effective processing technique, it has not been optimized specifically for the production of realistic plant-based meat analogs. The industry needs better models of plant protein denaturation, alignment, and crystallization within high-shear processing methods like high-moisture and low-moisture extrusion to inform the process variables for specific combinations of input materials, making the process more of a science and less of an art.

Novel texturizing equipment

A significant amount of work must be done to understand if there are more effective processes beyond extrusion. Determining this requires rigorously assessing and testing these novel methods, and optimizing them for the plant-based sector. Potential alternative production methods include couette shear cell, 3D printing, and processes developed from the weaving industry, including novel spinning technologies.

Cultivated & fermentation production priorities

There is a significant opportunity for industry stakeholders to develop novel bioprocessing techniques in order to efficiently create and isolate tissue, biomass, and target molecules at scale. There will increasingly be a pressing need to increase the amount of manufacturing capabilities and capacity not only for finished products, but also midstream and upstream in the supply chain.

Bioreactor innovation

Designing and sourcing bioreactors that are optimized for cultivated meat is similarly challenging, although the industry has a strong starting point by way of the biopharmaceutical sector. Nonetheless, existing industrial-scale bioreactors face technical challenges around agitation and shear force when used for cultivated meat. There is currently a gap between the economical solution and what is technologically possible based on scientific breakthroughs to date.

Lack of available, suitable infrastructure

The existing infrastructure that is technologically suitable for cultivated meat production has been designed for biopharma, a price-insensitive application at a much smaller scale than what will be needed to produce millions of metric tons of meat.

There is currently a finite amount of fermentation capacity for which numerous applications of the technology all compete.

Downstream processing

Post-bioreactor, downstream processing technologies such as cell harvesting and target molecule purification have yet to be optimized for cultivated meat and fermentation production processes, are expensive to run, and are not yet scaled.

Key production solutions

Read more about our proposed production solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

Investment innovation priorities

There are a variety of opportunities in the amount of financing flowing throughout the supply chain as well as the types of investors active in the space.

Cultivated & fermentation investment priorities

The recent explosion in R&D and commercial activity in cultivated meat and fermentation-derived products is leading to a vastly accelerating field. However, the rapid growth in the industry can lead to information gaps for investors. Investors beyond those who are intimately familiar with cultivated meat and fermentation approaches may find it time-consuming to know where to invest due to the dense competitive landscape, limited public information about the technological state of the art, and deep scientific knowledge required to conduct due diligence on startups. View GFI’s recommended technical questions for due diligence, as well as our list of technical due diligence consultants.

Key investment solutions

Read more about our proposed investment solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

Raw materials, ingredients, & inputs innovation priorities

Raw materials, ingredients, and inputs includes the development or optimization of novel and existing raw materials, ingredients, inputs, and functional additives as well as their processing. This section also covers ingredient costs as well as procurement and stakeholder coordination throughout the supply chain.

Plant-based ingredient/input priorities

Plant-based meat manufacturers seek plant-protein sources that are low-cost and available in robust supplies. This is why many companies use crops such as soy or wheat as primary ingredients since they are widely produced via industrial agriculture. Diversified plant protein sources are also needed, with manufacturers typically seeking out the following attributes: colorless, tasteless, high protein content, shelf stable, minimal processing requirements, clean label, and functionality that can replace less-desirable ingredients.

Crop breeding & optimized genetics

Crops have not historically been optimized for the protein content and functionality required by many plant-based foods. For instance, some protein isolates lack a neutral flavor, containing saponins and lipoxygenase, which can cause bitterness and beany off-flavors. To use these inputs, it is necessary to add costly flavors and additives as masking agents. Unfortunately, many flavors are absorbed and sequestered by components within the protein isolate, necessitating high levels of these additives. Crops should be specifically bred with lower levels of metabolites and enzymes that negatively impact taste.

Ingredient consistency and variability

As ingredient suppliers specialize and add more value to their ingredients upstream, the superficial volume of ingredients available cannot be used one-for-one in plant-based products. As a result, the supply to achieve sufficient volumes is fragmented, making it challenging to maintain standardized quality downstream in large-scale production. Ingredients from different suppliers exhibit a range of sensory and functional characteristics, leading to undesired variability in the end product formulation. Increased coordination throughout the supply chain will be important, as plant-based meat manufacturers benefit from raw materials processors and farmers working in concert to develop high-quality, homogenous ingredients.

Novel and specialty crop scaling infrastructure

Once novel crops with promising potential as alternative protein inputs are identified, it can be challenging to establish the agricultural infrastructure — from seeds and farm equipment to storage and transportation — that is necessary to enable efficient and scaled cultivation. It will be important to build the upstream supply chain infrastructure quickly enough to match growing demand. Traditional crop cycles make it hard to transition land quickly, and farmers may lack the expertise or risk tolerance to switch to crops that are more suitable for plant-based meat. To motivate farmers to switch to novel species or cultivars and de-risk their first few seasons, robust market data, insurance or price guarantees, and tailored technical assistance programs could ensure that plant-based inputs can be a profitable and competitive option for growers.

Cultivated input priorities

The development of a steady, reliable media supply that is sufficiently cheap is a mission-critical hurdle that must be overcome in order for cultivated meat to be successful.

Inexpensive and optimized media

Existing media and growth factor supply chains have largely been developed for the price-inelastic biotech and biopharma industries. Thus, they are too expensive, at too small a scale, and manufactured under certification regimes too burdensome to be viable for cultivated meat production.

Growth factors

Growth factors, which are not currently commercially available in food-grade versions, are widely noted as one of the most problematic inputs due to limited suppliers and high cost.

Specialized media providers

While some cultivated meat companies have become vertically integrated in order to develop their own media solutions at the proper scale and cost, this is an added scientific challenge and a resource-intensive endeavor that may be better addressed by a dedicated provider. Existing suppliers or prospective B2B partners feel they need additional regulatory clarity governing the requirements for manufacturing inputs for the cultivated meat industry.

Fermentation input priorities

Due to the sheer volume of raw materials required, feedstock is a key input cost in the fermentation process, regardless of the carbon source, microbe, or downstream processing techniques.

Feedstock shipping and sourcing

Shipping costs for feedstocks are high relative to the cost of the feedstock itself. While these are not notable bottlenecks for current uses of fermentation because sugar feedstocks are sufficiently cheap, of high enough quality, and in large enough supply, growing demand for fermentation will result in substantially increased needs for traditional feedstocks, which may become problematic but also represents an opportunity.

Feedstock consistency

Currently, alternative feedstocks remain highly inconsistent and there are concerns around the food safety and regulatory issues that may arise given the use of a lower grade, unconventional input such as an agricultural side streams.

Substrates

To reach mass commercialization, alternative, cheaper, and more sustainable substrates must become widely available.

Key raw material, ingredient, and input solutions

Read more about our proposed raw material, ingredient, and input solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

Distribution channel innovation priorities

Distribution channels encompass manufacturer sales within one of more of the following channels: foodservice, retail, distributors, direct to consumer (DTC), e-commerce, and business-to-business (B2B).

Key distribution channel solutions

Read more about our proposed distribution channel solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

Workforce innovation priorities

Workforce innovation priorities include solutions to attract and retain qualified talent throughout the alternative protein industry.

Key workforce solutions

Read more about our proposed workforce solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

Business services innovation priorities

Business services include intellectual property, insurance, operations, human capital, and other advisory services.

Key business services solutions

Read more about our proposed business services solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

Demand generation innovation priorities

Demand Generation includes a broad array of subjects related to consumer awareness, perception, and adoption of alternative proteins.

Key demand generation solutions

Read more about our proposed demand generation solutions—including related efforts by GFI and other organizations that are already underway—in our Solutions Database.

How we built this

Executive summary

Get an overview of GFI’s Advancing Solutions for Alternative Proteins initiative and a summary of key resources.

Full report

Delve into the full report on the motivation, methodology, rationale, and key findings and recommendations of the Advancing Solutions for Alternative Proteins initiative.

Futures wheels analysis

Explore our framework for uncovering second-order or third-order consequences and implications of hypothetical future scenarios to support better decision-making in the present.

Future-proofing

Discover key findings from GFI’s premortem analysis of potential threats to the widespread adoption of alternative proteins, including strategies to avoid or mitigate the most pressing risks.

How GFI advances alternative protein innovation

GFI is a nonprofit working internationally to make alternative proteins delicious, affordable, and accessible. We play a unique and vital role in identifying and addressing the alternative protein industry’s shared challenges, and we work to transform each step of the value chain more rapidly and on a larger scale than conventional market forces would allow.

GFI accelerates the transition toward a better food system by surfacing the most pressing problems and most important solutions critical to the growth of the alternative protein market. By offering a menu of recommendations for building a resilient and sustainable alternative protein industry, GFI helps businesses, investors, nonprofits, academic researchers, and governments prioritize efforts supporting the alternative protein industry and channel resources effectively.

All of this work is made possible by our generous community of donors. If you’d like to support GFI’s open-access research and efforts to advance the alternative protein industry, please contact us.

Be part of the solution

If you’d like to fund related research in these innovation areas, work on any of these challenges, share similar projects that are already underway, or elevate new ideas for advancing the alternative protein industry, we’d love to hear from you!