U.S. retail market insights for the plant-based industry

Explore our overview of retail sales data for plant-based meat, dairy, eggs, and other categories in the U.S. market including key category insights, size, growth, and purchase dynamics for the industry.

The plant-based food industry is evolving

Food manufacturers ranging from startups to leading CPG companies to the world’s largest meat companies are innovating rapidly in the plant-based market. Next-generation plant-based meat, egg, and dairy products are increasingly competitive with animal products on taste, price, and accessibility, though more opportunities remain. Distribution has meaningfully expanded over the past several years and products have increasingly appealed to meat-eating consumers. In U.S. retail in 2022, 93% of households that bought plant-based meat also purchased conventional meat.

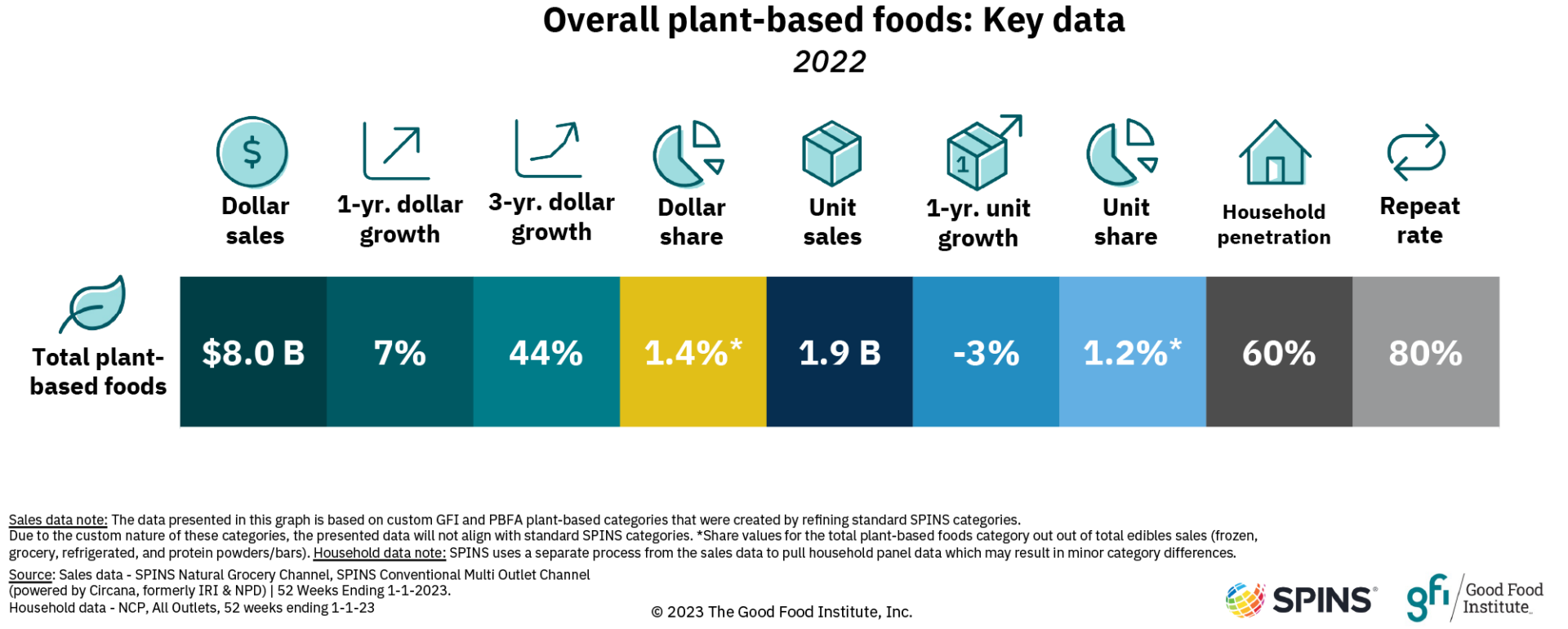

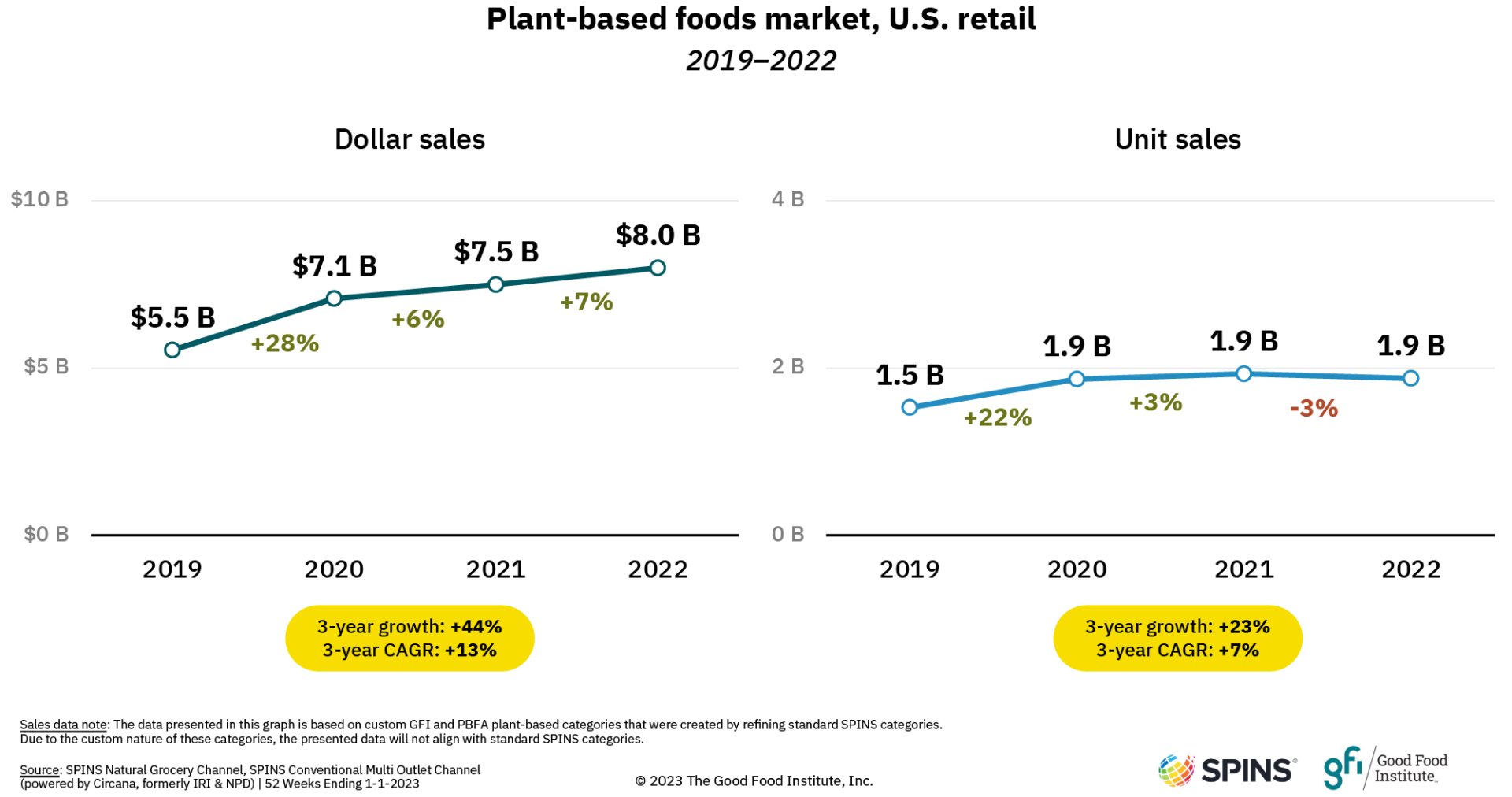

In U.S. retail alone, plant-based foods are an $8 billion market

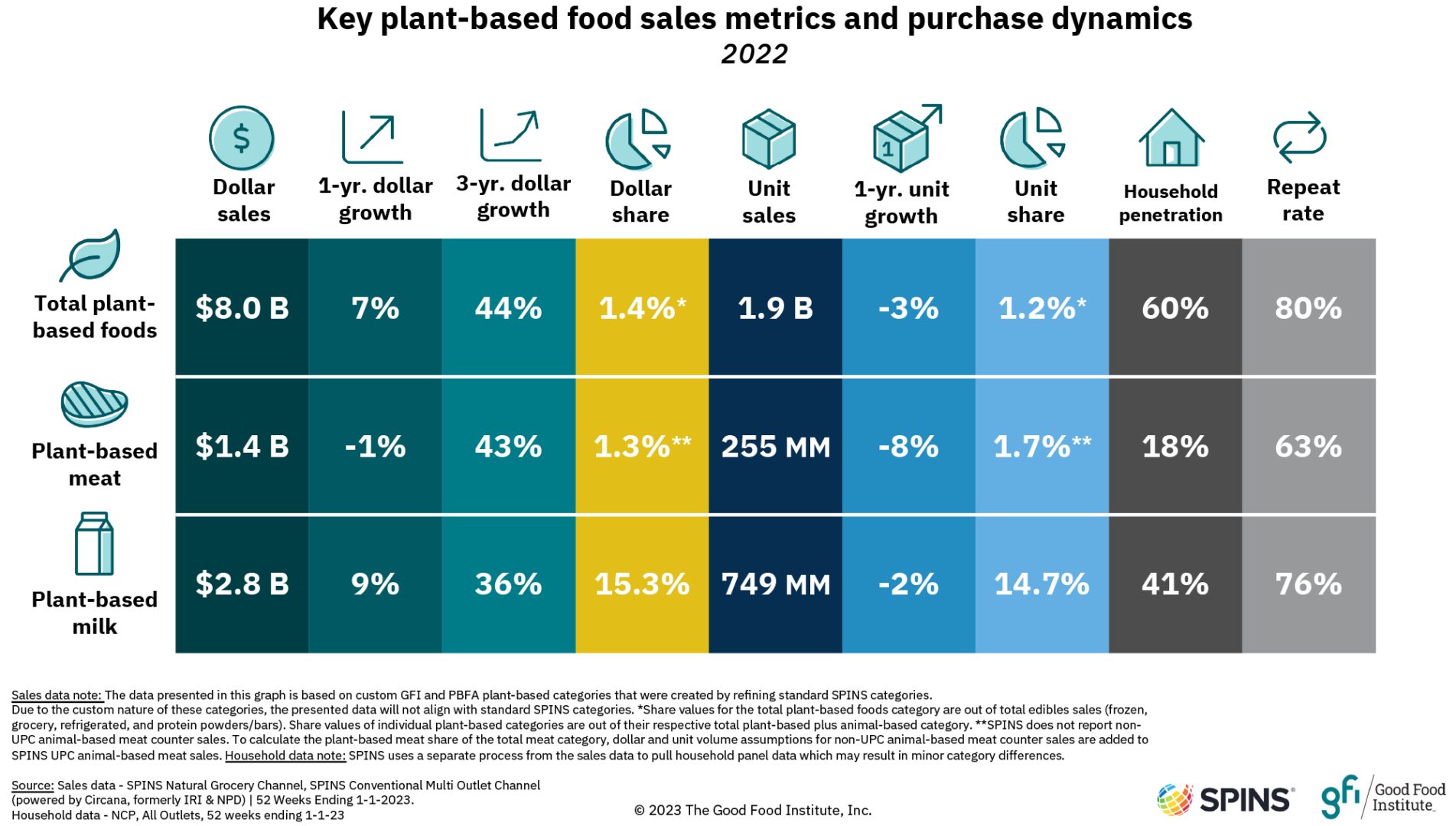

Insights released by the Good Food Institute (GFI) and the Plant Based Foods Association (PBFA) based on retail sales data commissioned from SPINS show that the plant-based food market in U.S. retail in 2022 is worth $8 billion, with dollar sales up 7% from 2021, and units down 3%, mirroring total food and beverage and animal-based food. While dollar sales are up across several categories due to price increases, notable plant-based categories that saw unit sales growth in 2022 despite challenging market conditions include plant-based eggs, plant-based seafood, plant-based creamers, and plant-based protein liquids and powders. With inflation and consumer spending concerns playing a large role in the retail market in 2022, many plant-based categories saw overall dollar sales increases and unit declines. Distribution in several plant-based categories increased slightly, including plant-based meat (driven by new product launches and expanded distribution in key areas like plant-based chicken), plant-based creamer, and plant-based eggs.

In the long-term, plant-based foods have represented a key growth driver for U.S. retail food. From 2019 to 2022, benchmarking before Covid, plant-based food unit sales growth outpaced that of both animal-based food and total food. Meanwhile, consumer tailwinds are still strong, with consumer research showing that many are interested in cutting back their meat consumption and/or increasing their consumption of plant-based foods. Research from Credit Suisse found that, among consumers aged 16-40 across 10 countries, 66% plan to spend more on plant-based meat and dairy alternatives in the future. Yet product development and enhancement opportunities remain, including to improve taste and lower prices in the plant-based meat category.

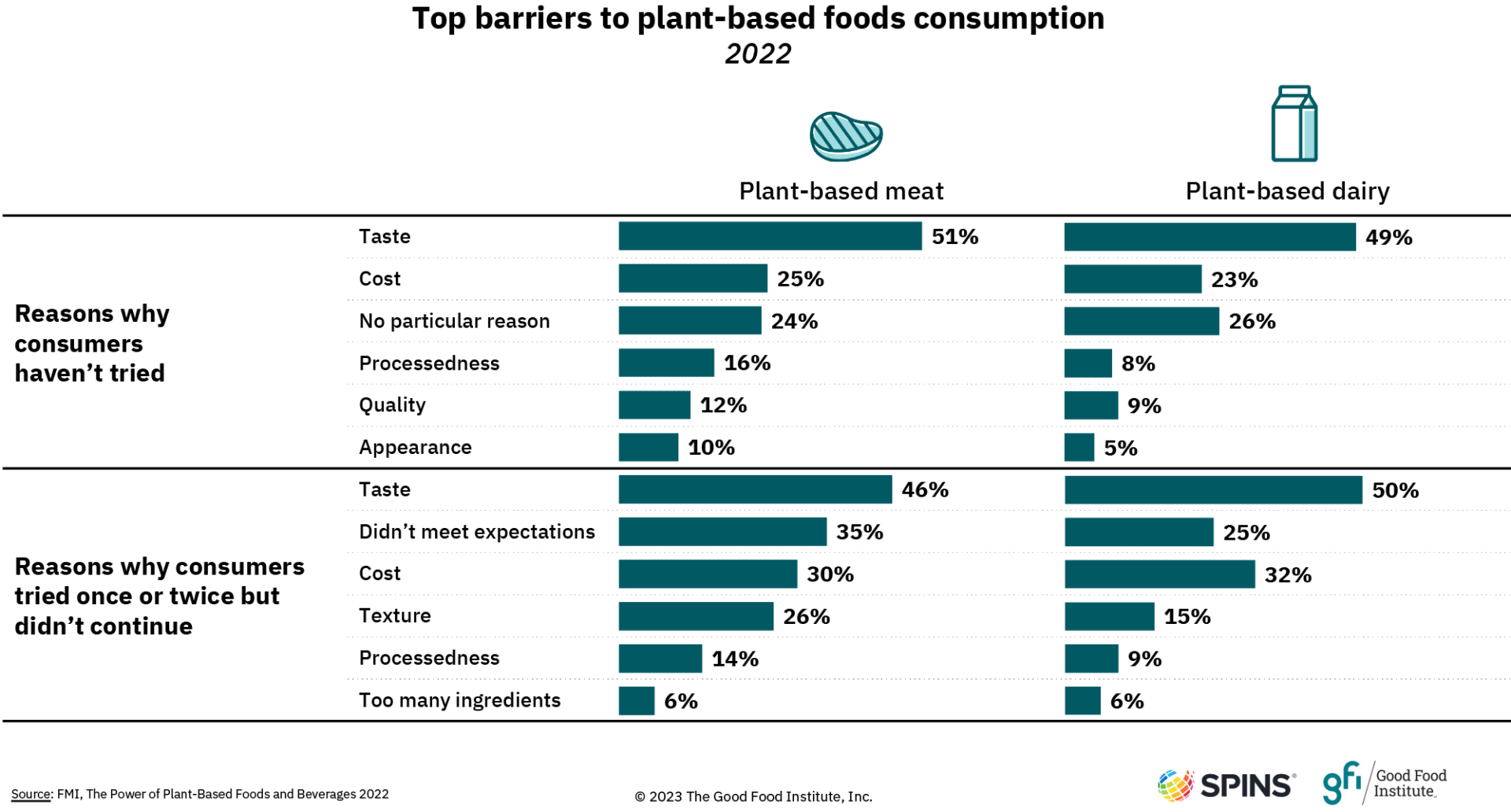

Taste is the primary barrier to consumption of plant-based foods. According to Mintel, 53% of all consumers agree that plant-based protein products should taste indistinguishable from meat. Similarly, research from FMI shows that perception of taste is the top reason why consumers haven’t tried plant-based meat or dairy, as well as the top reason why consumers who have tried them once or twice haven’t continued purchasing. Cost is overall the second most important factor:

These trends underscore the need to continue investing in advances toward plant-based products that reach taste and price parity with conventional products. This will help attract new consumers, particularly meat-eaters, to the category and increase repeat rates with existing consumers.

Note: The data used in this report, unless otherwise noted, is based on SPINS plant-based positioned attribution, with the additional inclusion of plant-based private-label products. Due to the nature of these categories, the presented data may not align with standard SPINS categories. Read more about our methodology. We’ve summarized highlights from the data below to help you understand key metrics for the U.S. retail plant-based food industry. We cover both the plant-based food market as a whole and key plant-based categories like meat and milk.

The U.S. retail market for plant-based foods is worth $8 billion.

6 in 10 U.S. households purchased plant-based foods in 2022, similar to prior year.

Plant-based foods made up 1.4% of total retail food and beverage dollar sales in 2022.

93% of households that bought plant-based meat in 2022 also bought animal-based meat.

Summarizing plant-based food market sales data

Impacts from global trends

Inflation

Inflation was a major story across the globe in 2022, particularly in the food sector. In the U.S., from December 2021 to December 2022, food-at-home prices rose 12%, which influenced how consumers shopped. According to IRI’s December primary shopper survey as reported by 210 Analytics, 8 in 10 consumers report making changes to their shopping behavior as a result of price increases. Full-year 2022 data on total edibles shows a decline in total food and beverage consumption with unit sales down 3% and dollar sales up 11% versus the prior year. Notably, categories like conventional meat and plant-based meat experienced gaps between dollar sales changes and unit sales changes, representing significant price-per-unit increases.

In addition to price increases for a given category, inflation cuts into consumer budgets and tends to influence consumers to trade down from existing premium categories—almost all plant-based categories continue to sell at a price premium per pound compared to their animal-based counterparts.

Reaching price parity with conventional meat remains a large barrier to mass adoption for the plant-based meat category. According to Mintel, 26% of consumers who don’t eat plant-based proteins today say the products are too expensive. Research from FMI shows that cost is a major factor identified by almost a third of consumers who stop buying plant-based meat or dairy. Overall, the premium prices of plant-based foods present a barrier to reaching more consumers and with more frequency, particularly given that consumers are likely to be increasingly mindful of prices in the current economic environment.

Supply chain disruptions

A major contributor to the decreased affordability and availability of food in 2022 was continued ingredient shortages and supply chain disruptions. Events including but not limited to the war in Ukraine, extreme weather, continued pandemic impacts like labor shortages, and avian flu outbreaks have had ripple effects across the global food network.

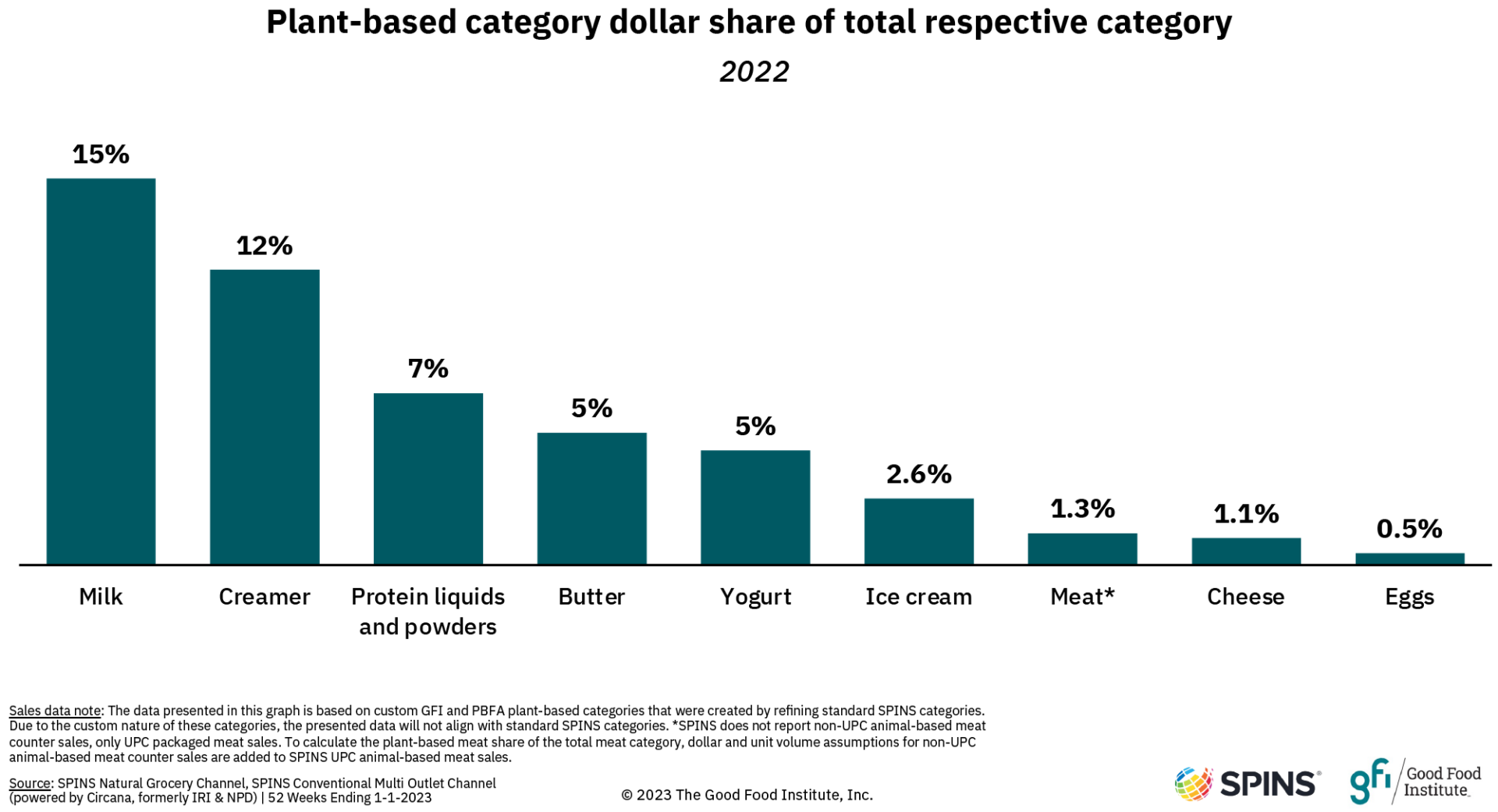

Neither plant-based nor animal-based foods have been entirely immune to these challenges. Both plant- and animal-based proteins were impacted by lower-than-anticipated global pea and soybean yields, sanctions on Russia—the world’s largest fertilizer exporter—and elevated energy costs, all of which drove up costs of production. Rising sea and rail freight costs also contributed to price increases for both plant and animal proteins. Yet the environmental benefits, production efficiencies at scale, and minimized supply chain vulnerabilities compared to the animal agriculture industry make plant-based foods a powerful tool in building a stable food supply. The plant-based industry is still small relative to the total food industry. Plant-based milk has a 15% dollar share of total milk, plant-based meat has a 1% dollar share of total meat, and the plant-based egg category has a dollar share of 0.5% of overall eggs in U.S. retail. Continued public and private investment are needed to scale the industry, improve taste and price parity with conventional meat, egg, and dairy products, and improve the industry’s ability to attract and retain consumers.

Lingering pandemic impacts

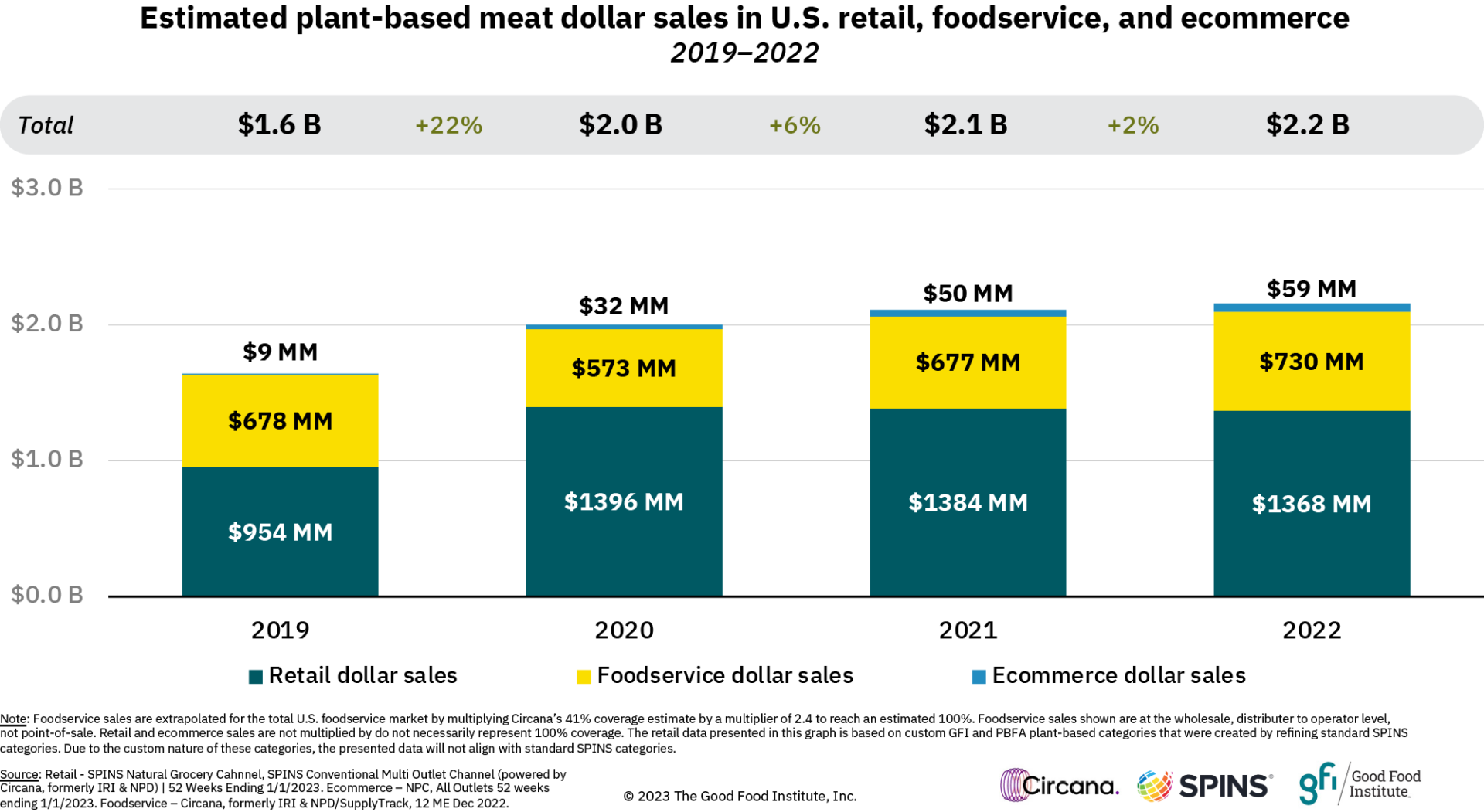

Looking at the retail channel alone risks missing the larger picture of plant-based food sales in the U.S. given individual channel volatility across retail, foodservice, and ecommerce in the past four years. In 2020, due to the pandemic, a large portion of foodservice dollars shifted from foodservice to retail. Across categories, this resulted in unprecedented retail growth—and high bars for lapping this growth. 2021 and 2022 have seen the foodservice channel earn back much of its prior volume, and retail volume has started to settle. Meanwhile, ecommerce sales have grown rapidly, although on a very small base, stimulated by the pandemic.

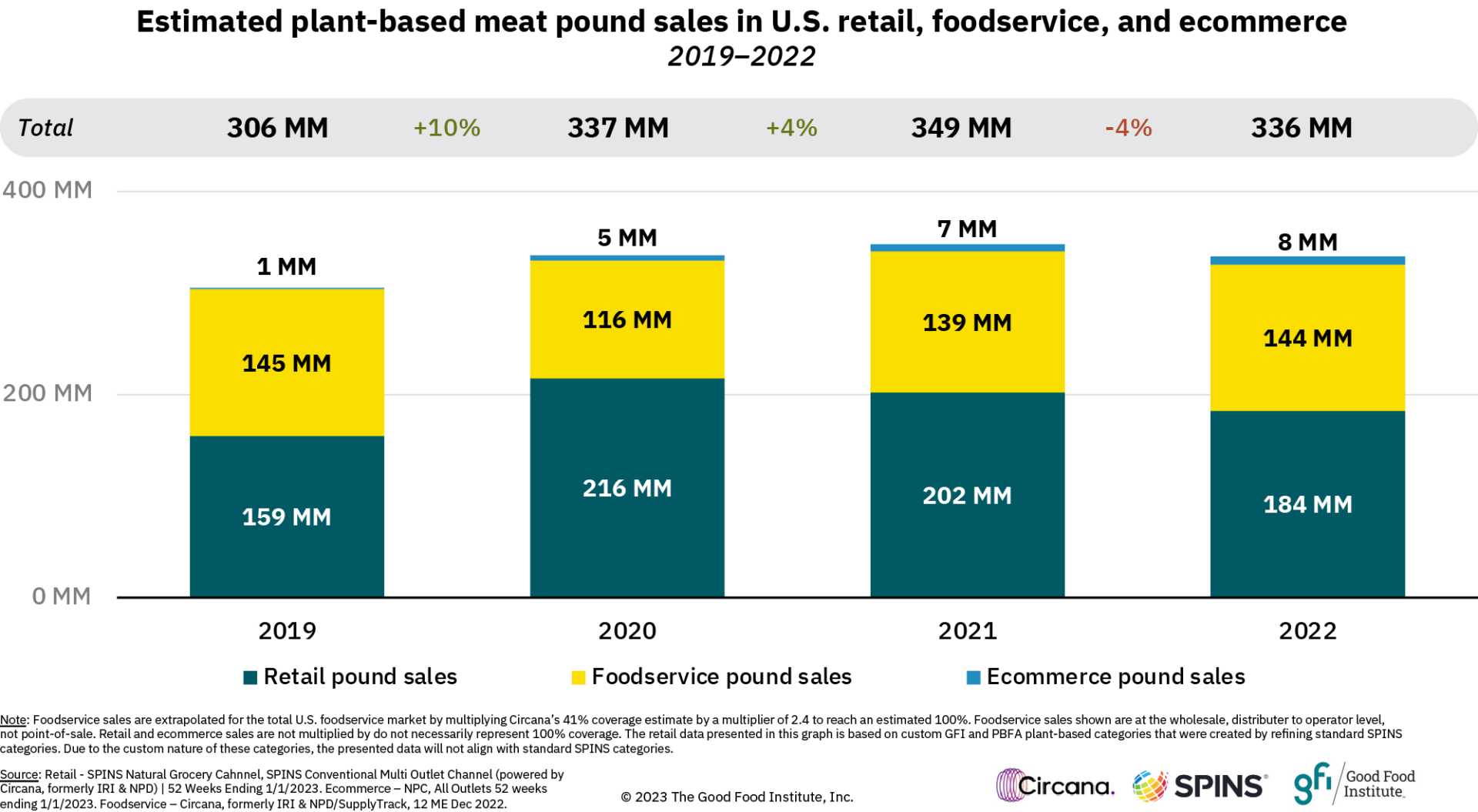

Stabilization after volatile channel switches during peak pandemic

Combining retail, estimated foodservice, and ecommerce sales (which GFI has for only the plant-based meat category) helps to smooth out some of the individual channel volatility during and after peak pandemic shopping. In 2022, estimated total plant-based meat dollar sales increased slightly by 2% while estimated pound sales decreased by 4%.

Notes: Foodservice sales are extrapolated for the total U.S. foodservice market by multiplying Circana’s 41% coverage estimate by a multiplier of 2.4 to reach an estimated 100%. Foodservice sales shown are at the wholesale, distributor to operator level, not point-of-sale. Retail and ecommerce sales are not multiplied but do not necessarily represent 100% coverage. The retail data presented in this graph is based on custom GFI and PBFA plant-based categories that were created by refining standard SPINS categories. Due to the custom nature of these categories, the presented data will not align with standard SPINS categories.

Today, although restrictions have continued to lift and purchases have stabilized, the pandemic continues to have lasting impacts on the broader food industry and consumer behavior. A brief example of an opportunity for plant-based foods at retail is buying in bulk—one of the pandemic’s lasting impacts on shoppers is an increased tendency to buy in bulk. However, many plant-based products are not available in bulk sizes, which often offer consumers greater efficiencies in per-pound prices.

The challenges discussed above represent significant hurdles not only for the food system at large but especially for the emerging plant-based food industry. Volatile periods like those seen over the last four years underscore that the success of plant-based categories is not inevitable. In order to continue to drive consumer demand and compete with conventional products, plant-based foods need increased public and private investment to improve critical attributes such as taste, price, and accessibility. Such investments can increase the positive impacts of plant-based foods to help sustainably and efficiently feed billions of people, mitigate the global climate impact of our meat production, and, notably, protect public health and lessen the risk of future pandemics.

Overview

In 2022, total plant-based food dollar sales grew 7% while unit sales declined by 3%. 6 in 10 U.S. households purchased plant-based foods, similar to the prior year.

While plant-based foods outpaced animal-based foods in both dollar and unit sales growth from 2019 to 2021, in 2022 the retail landscape shifted. Both animal-based and plant-based category unit sales declined, and prices per unit increased. 8 in 10 households purchased more than once across all plant-based categories. This means that 20% of shoppers purchased plant-based foods on only one occasion throughout the year, highlighting an opportunity to increase repeat rates.

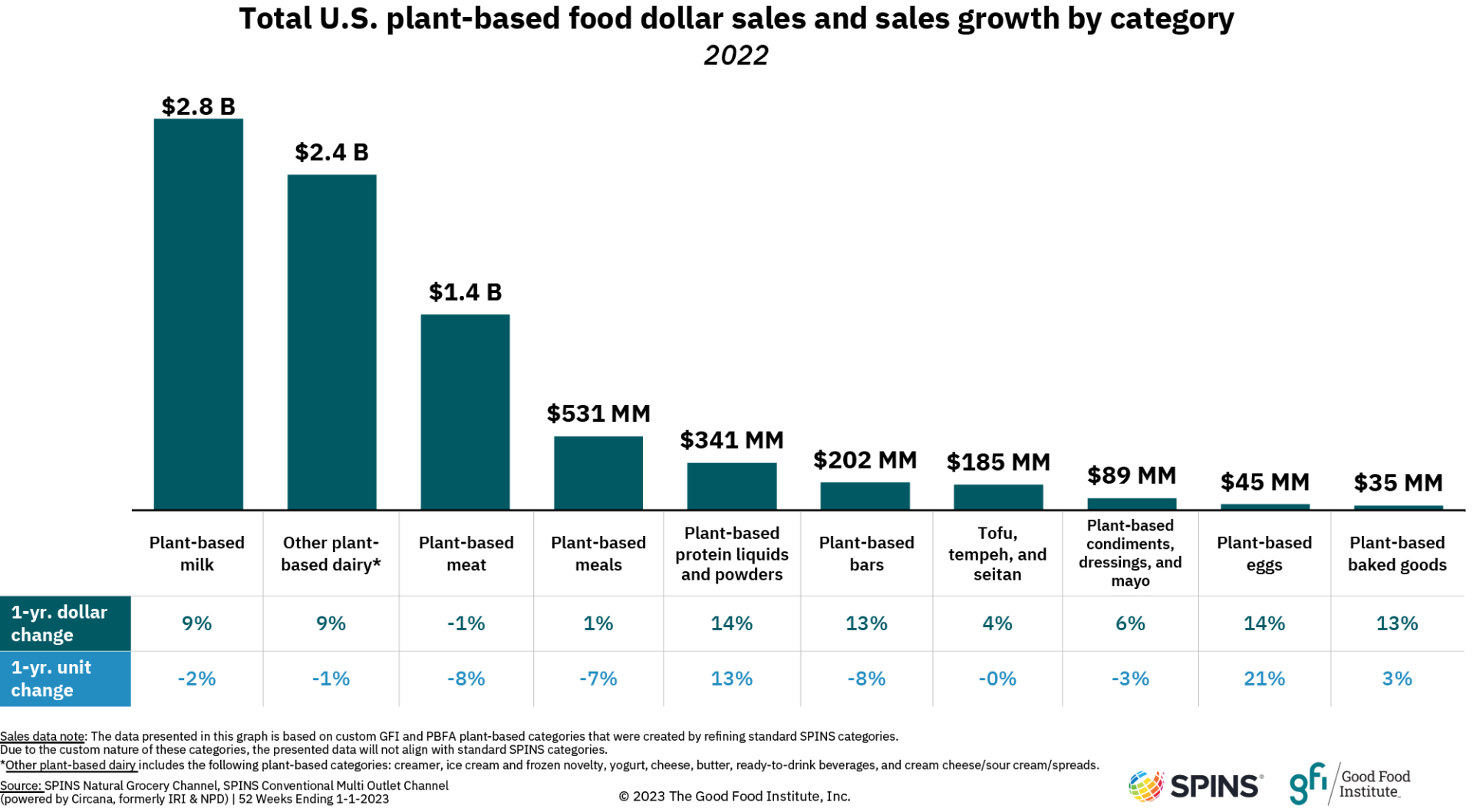

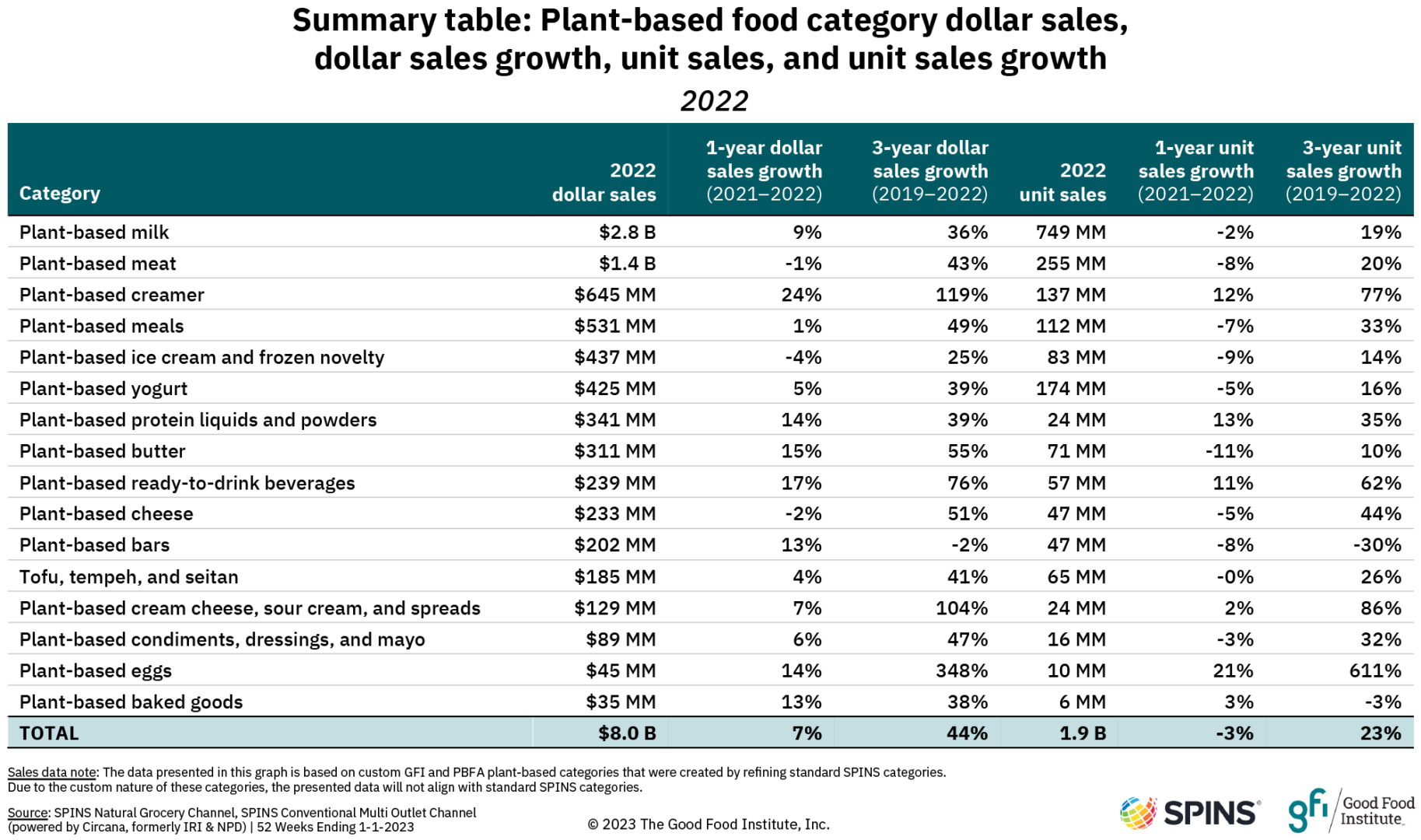

Categories

Plant-based food categories are in various stages of development. Plant-based milk is a multi-billion-dollar category with a 15% market share of total milk dollar sales, while small but emerging categories such as plant-based eggs saw continued growth in 2022.

Key insights

- Plant-based milk is the most developed of all plant-based categories. Plant-based milk dollar sales were $2.8 billion in 2022, making up over a third of all plant-based sales.

- Plant-based meat dollar sales are down slightly by 1% and unit sales are down 8%. This indicates an opportunity to further attract and retain consumers in the category by delivering great-tasting, affordable products that meet consumer needs.

- As with total food and beverage at retail in 2022, several plant-based categories saw dollar volume growth alongside unit volume declines. However, a few notable categories grew in both dollar and unit sales in 2022, including plant-based creamers, eggs, and protein liquids and powders.

- The smallest category, and the fastest-growing, is plant-based eggs. At $45 million in dollar sales in 2022, plant-based eggs is a modest category that has grown 4x its size in 2019, albeit on a very small base. Plant-based eggs have also seen a significant closing in the price gap with animal-based eggs, driven by both price increases for animal-based eggs and price per unit decreases for products in the plant-based egg category.

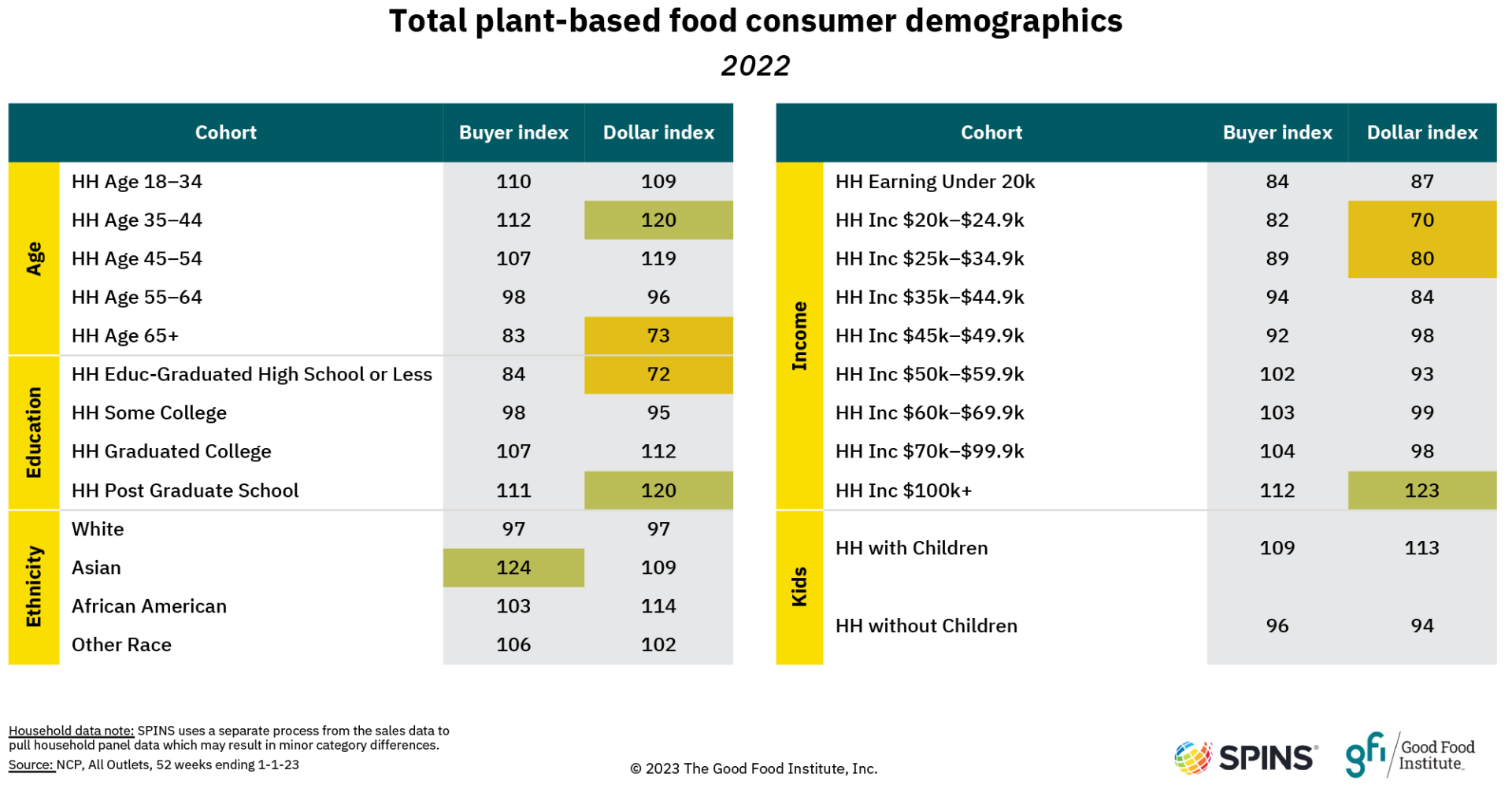

Overall consumer demographics

Plant-based food consumption is a trend among several consumer groups. Compared to the average consumer, consumers aged 35-44 and those who are from higher income beckets are more likely to spend more on plant-based products. Asian consumers are more likely to be buyers of plant-based foods.

Closing the price gap

The majority of plant-based categories and every animal-based category had positive dollar sales growth in 2022. However, all animal-based categories and most plant-based categories experienced unit sales declines, indicative of the trends in U.S. retail of increasing average price-per-unit.

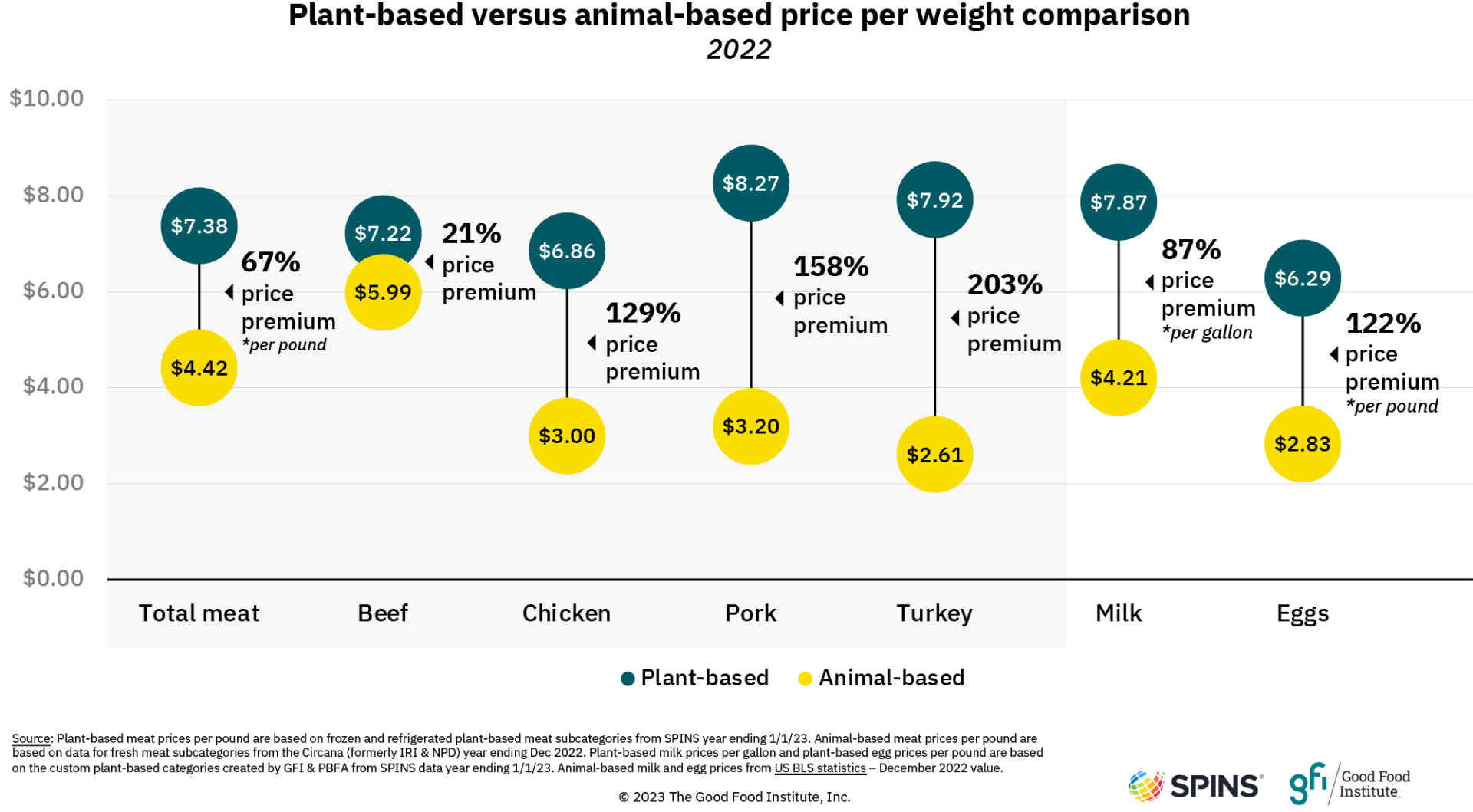

Plant-based products tend to be sold at a significant price premium compared to conventional products. Closing this price gap represents an opportunity to appeal to more consumers and position products as more feasible swap-outs for conventional products. GFI analysis of multiple data sources indicates that, in 2022, pound for pound, the overall price premium for plant-based meat was 67%, and for plant-based eggs was 122%. Gallon for gallon, the overall price premium for plant-based milk was 87%.

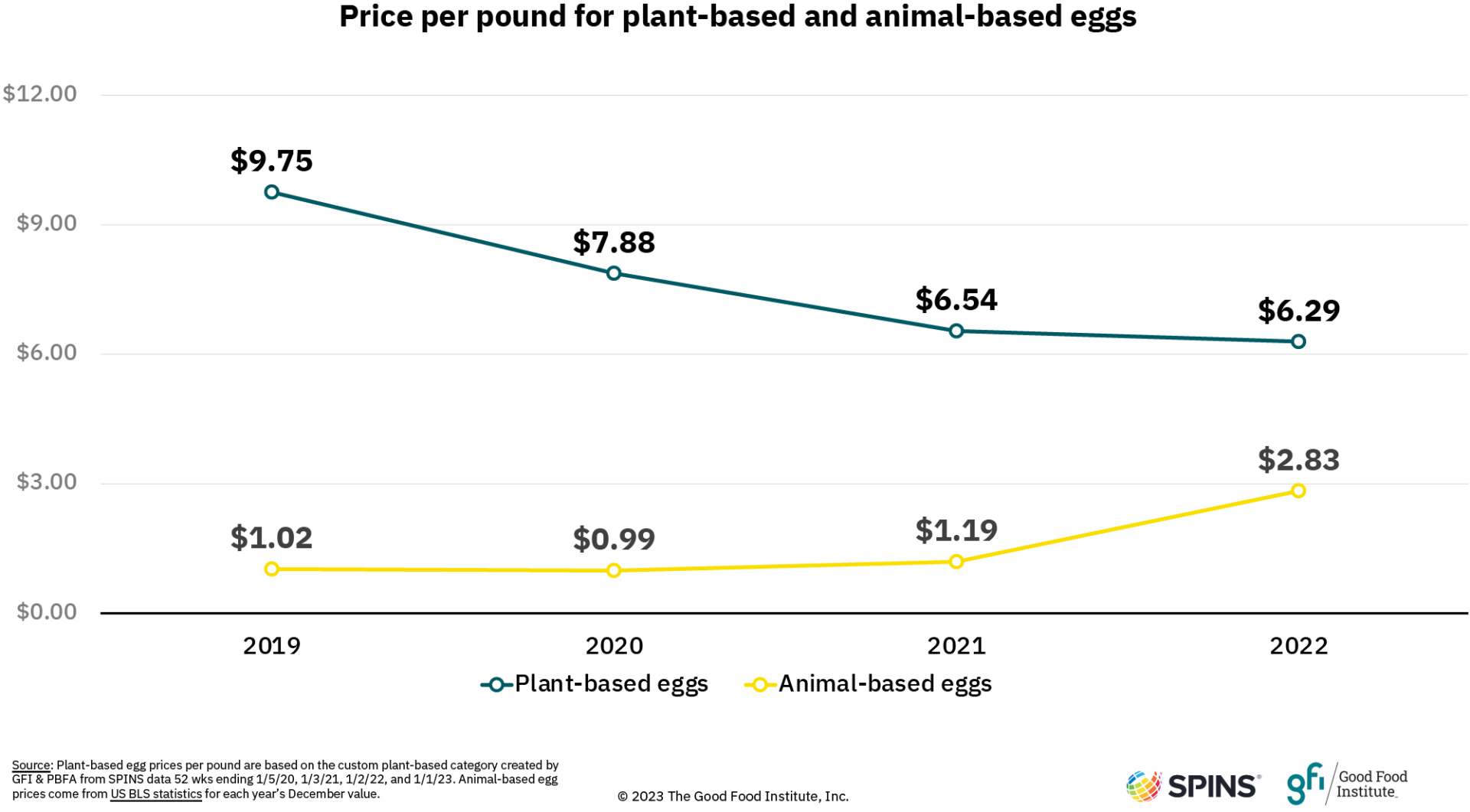

The plant-based egg category made notable progress toward price parity in 2022. In 2021, plant-based eggs cost about $5 more per pound than animal-based eggs. This gap shrank to $3.50 in 2022, driven primarily by animal-based egg price increases and secondarily by decreases in plant-based egg prices.

Purchase dynamics

Recent unit sales declines within the plant-based foods sector are supported by decreasing velocities in key plant-based categories as well as slight declines in household penetration and repeat rates.

Key insights

- Six in ten households purchased plant-based foods in 2022. The majority of U.S. households are purchasing plant-based products, similar to in 2021.

- Plant-based milk continues to lead plant-based categories in household penetration. 41% of U.S. households purchased plant-based milk in 2022, the highest household penetration among plant-based categories, followed by plant-based meat (18%) and plant-based ice cream and frozen novelties (12%).

- In line with overall sales trends, several plant-based categories saw slight (2 points or less) declines in the portion of households purchasing in 2022. These included plant-based meat, milk, ice cream and frozen novelty, and yogurt. This was consistent across the retail space, as several analogous animal-based categories had similar slight declines in households purchasing.

- Other plant-based categories had a relatively steady percent of households purchasing. Plant-based cheese, eggs, and tofu, tempeh, and seitan had similar proportions of households purchasing them in 2022 as in 2021. Notably, plant-based egg repeat rates increased by 5 percentage points from year prior.

- Plant-based meat shoppers are major consumers of other plant-based categories. Of households that purchased both plant-based and conventional meat in 2022, 65% also purchased plant-based milk and 26% purchased plant-based ice cream and frozen novelties. This was higher than the baseline rates of total households purchasing in those categories, which was 41% for plant-based milk and 12% for plant-based ice cream, demonstrating the many consumers cross-purchase across multiple plant-based categories.

- Dollar sales per buyer for households that purchase both plant-based meat and animal-based meat is higher than for the average household. These households spent 19% more than the average household, and 21% more than an average household that purchases animal-based meat but not plant-based meat.

Plant-based meat and seafood

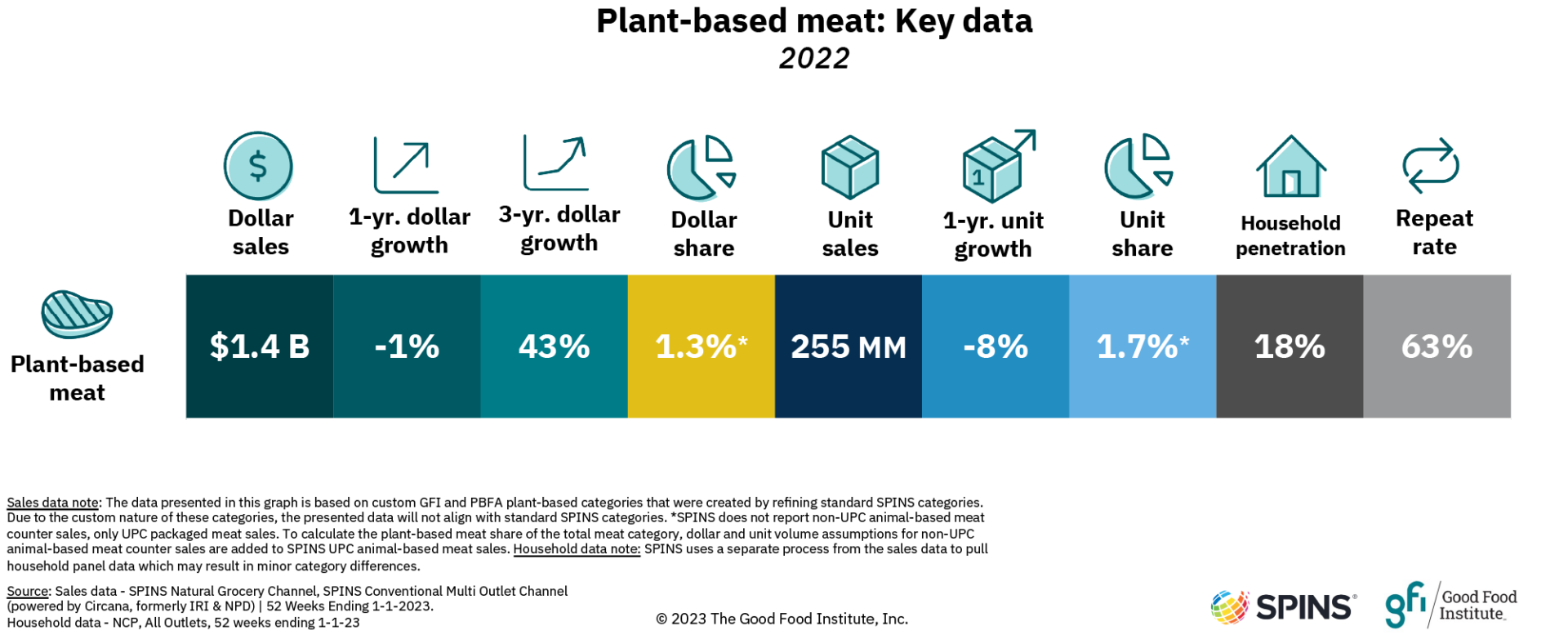

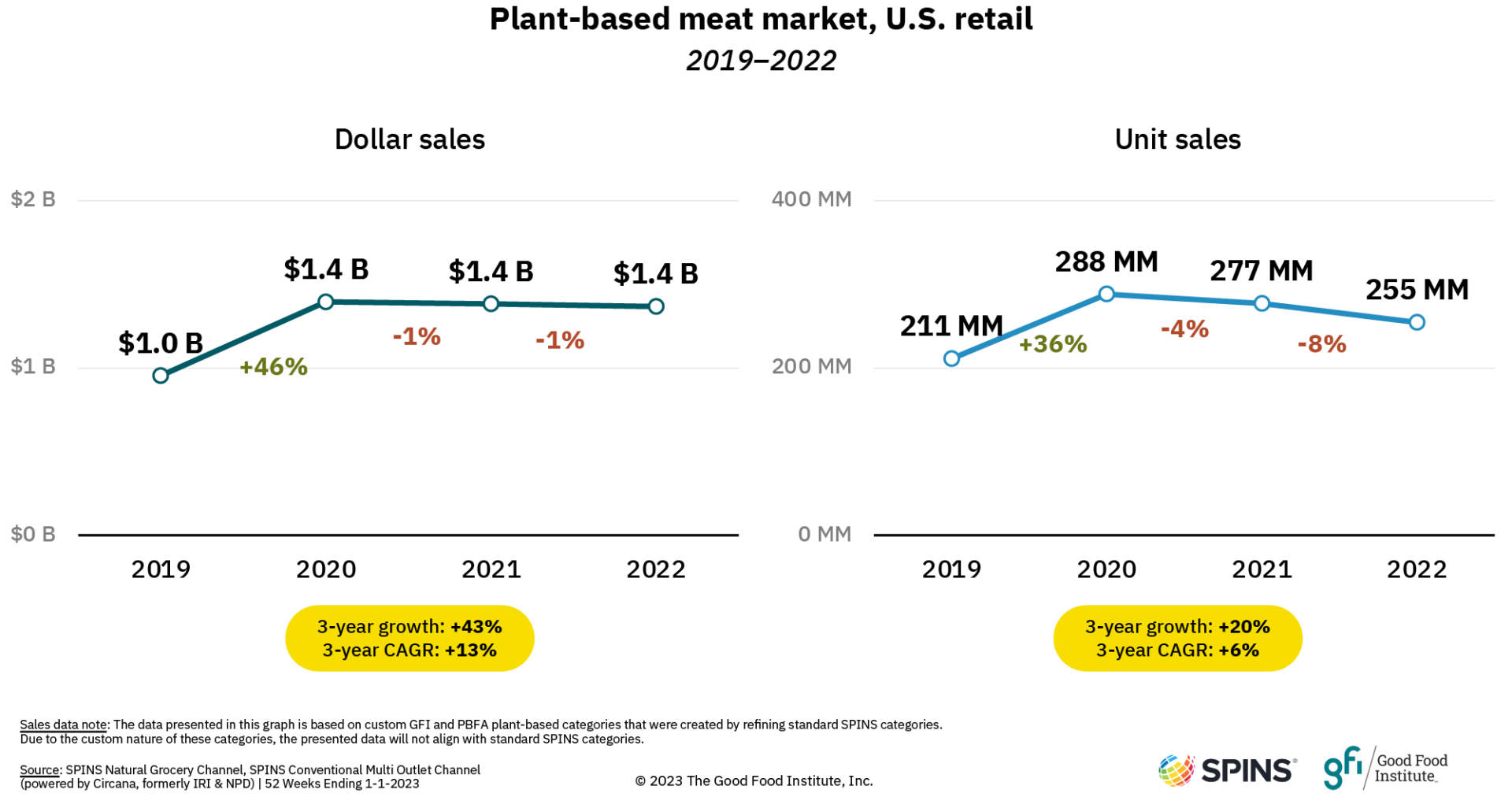

After record growth in years prior, in 2022, plant-based meat and seafood dollar sales declined very slightly by 1%, while unit sales declined 8%.

Plant-based meat sales

In 2022, plant-based meat dollar sales declined very slightly by 1% and unit sales declined by 8%.

Despite these latest year trends, a deeper look into the category reveals areas of growth and opportunity, and sales remain higher than pre-pandemic levels. For more information and analysis on the plant-based meat category’s sales performance, read our blog post, 2023 outlook: The state of plant-based meat sales, where we share insights into where the plant-based meat category is today and what that means for its future.

Key insights

- Plant-based meat sales remain elevated compared to pre-pandemic levels. Since 2019, dollar sales for plant-based meat have grown 43%, mainly boosted by the substantial growth in 2020. Unit sales have increased by 20% since 2019.

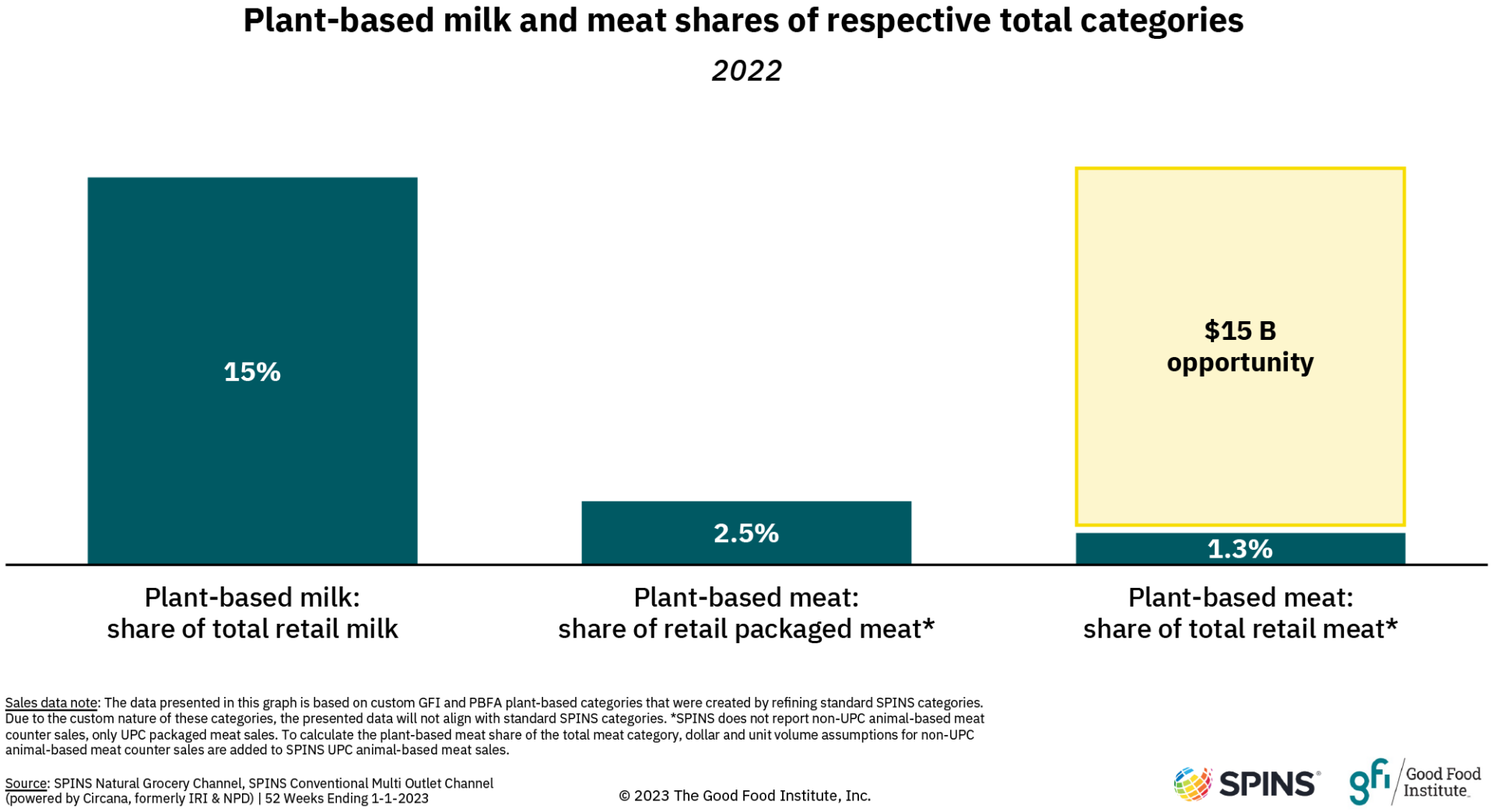

- Plant-based meat’s market share is steady. In 2022, plant-based meat’s share was 2.5% of total retail packaged meat dollar sales or 1.3% of the total meat category* (including random-weight meat), similar to in 2021.

- Plant-based meat’s market share in the natural channel is in the double digits. In the natural channel—where retail trends tend to start before disseminating into grocery and mass—plant-based meat’s market share of packaged meat dollar sales is higher, at 15%, compared to its 2.5% share of total marketplace packaged meat dollar sales.

- Opportunities exist to reach more households. The portion of U.S. households purchasing plant-based meat decreased slightly from 19% in 2021 to 18% in 2022. Attracting more households to the category presents a significant opportunity for products to reach new consumers.

- Plant-based meat shoppers are similar demographically to overall plant-based food shoppers. In particular, plant-based meat buyers are more likely to be Asian. African American or Gen X buyers are more likely to spend more in the plant-based meat category.

*SPINS does not report non-UPC animal-based meat counter sales, only UPC packaged meat sales. To calculate the plant-based meat share of the total meat category, GFI develops dollar and unit volume assumptions for non-UPC animal-based meat counter sales and adds them to the SPINS UPC animal-based meat sales.

Segment insights

Refrigerated vs. frozen vs. shelf stable

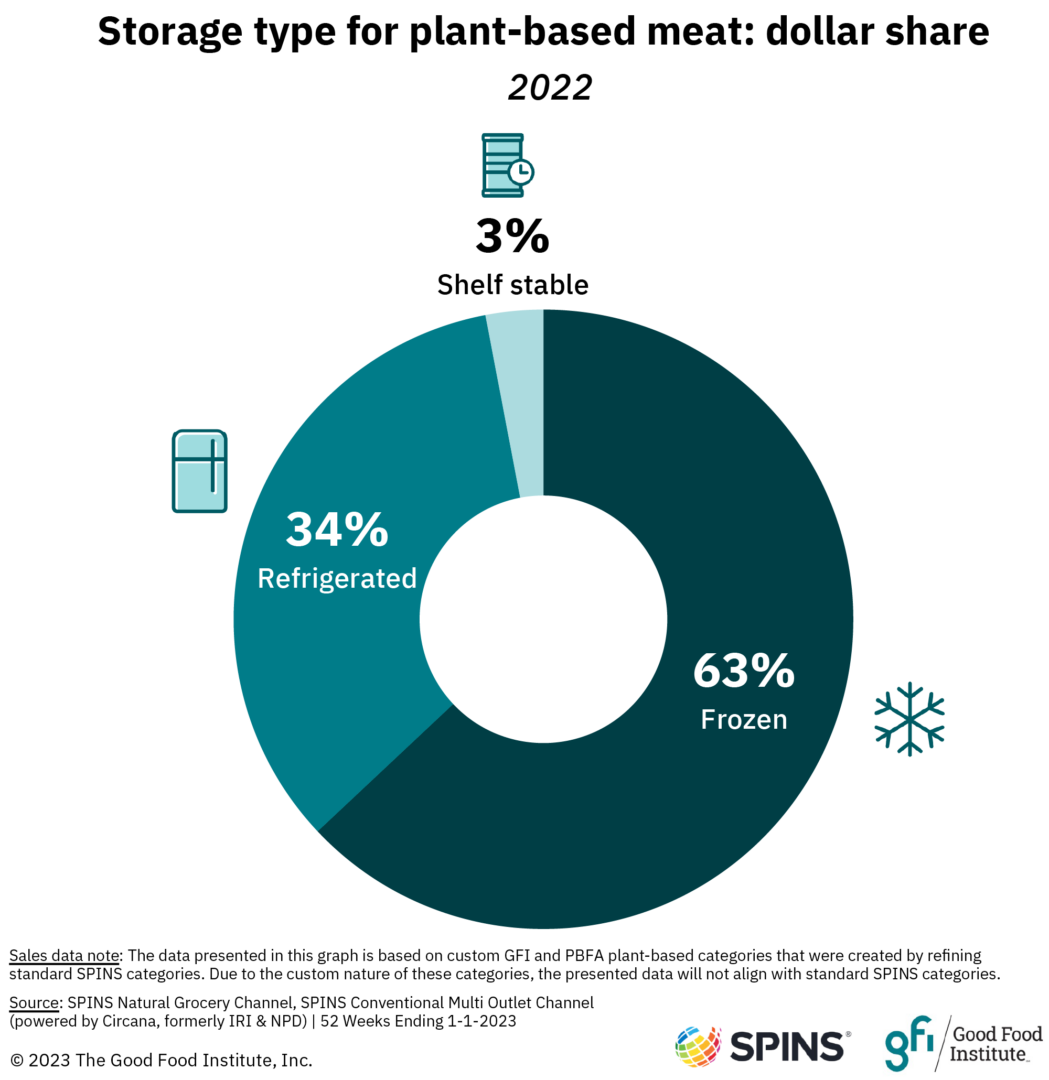

- Frozen plant-based meat continues to compose the majority of the category by dollar sales, representing 63% of total plant-based meat sales, followed by refrigerated plant-based meat at 34% and shelf stable plant-based meat at 3%.

- In 2020, refrigerated plant-based meat jumped to 39% of category dollar sales from 32% in 2019. In 2022, however, the category saw a shift back to the frozen aisle with refrigerated items losing 5 percentage points of their dollar share to frozen (+3 pts) and shelf-stable items (+2 pts).

- Looking at units, although both frozen and refrigerated plant-based meat unit sales declined in 2020, refrigerated unit sales declined by 14%, twice as much as frozen, which declined by 7%.

- Notable factors that may have contributed to this dynamic include:

- The possibility that price and economic concerns may have driven consumers to plant-based meat products in the frozen aisle that tend to have lower price points and sustained shelf life.

- Meanwhile, average per-unit prices of frozen plant-based meat grew 13% (which could contribute to increased dollar sales totals), compared to just 1% for refrigerated products, and 2% for shelf-stable products.

- Additionally, there were several new category launches in frozen formats like plant-based chicken nuggets and tenders as well as plant-based filets, steaks, and cutlets, and notable product launches in shelf-stable plant-based jerky.

- Historically, refrigerated plant-based meat has been a key growth driver for the category, as it has been increasingly shelved in the meat case (rather than a specialty vegan case), enabling it to be located in the section of the store where most shoppers are looking for center-of-plate proteins.

For more insights on how to capitalize on merchandising strategies for the plant-based meat market, check out our merchandising guide.

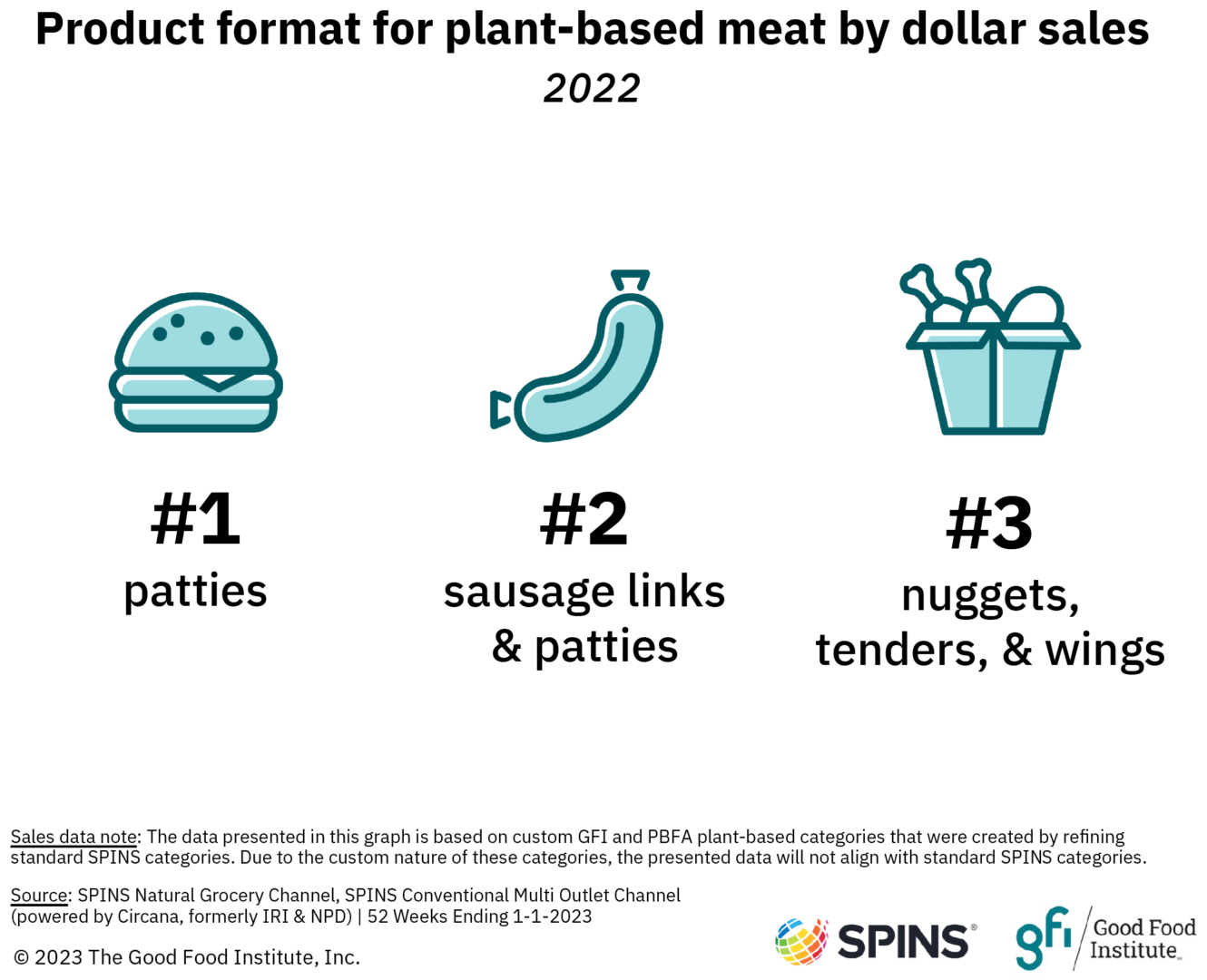

Plant-based meat formats

- Plant-based patties continue to be the largest plant-based meat product type, followed by sausage links and patties, then nuggets, tenders, and wings.

- At the same time, the industry is responding to consumer desire for more variety within the category. The fastest-growing plant-based meat product types in 2022 were plant-based nuggets, tenders, and wings; filets, steaks, and cutlets; and jerky snacks. Much of this growth was driven by new product launches and gains in distribution.

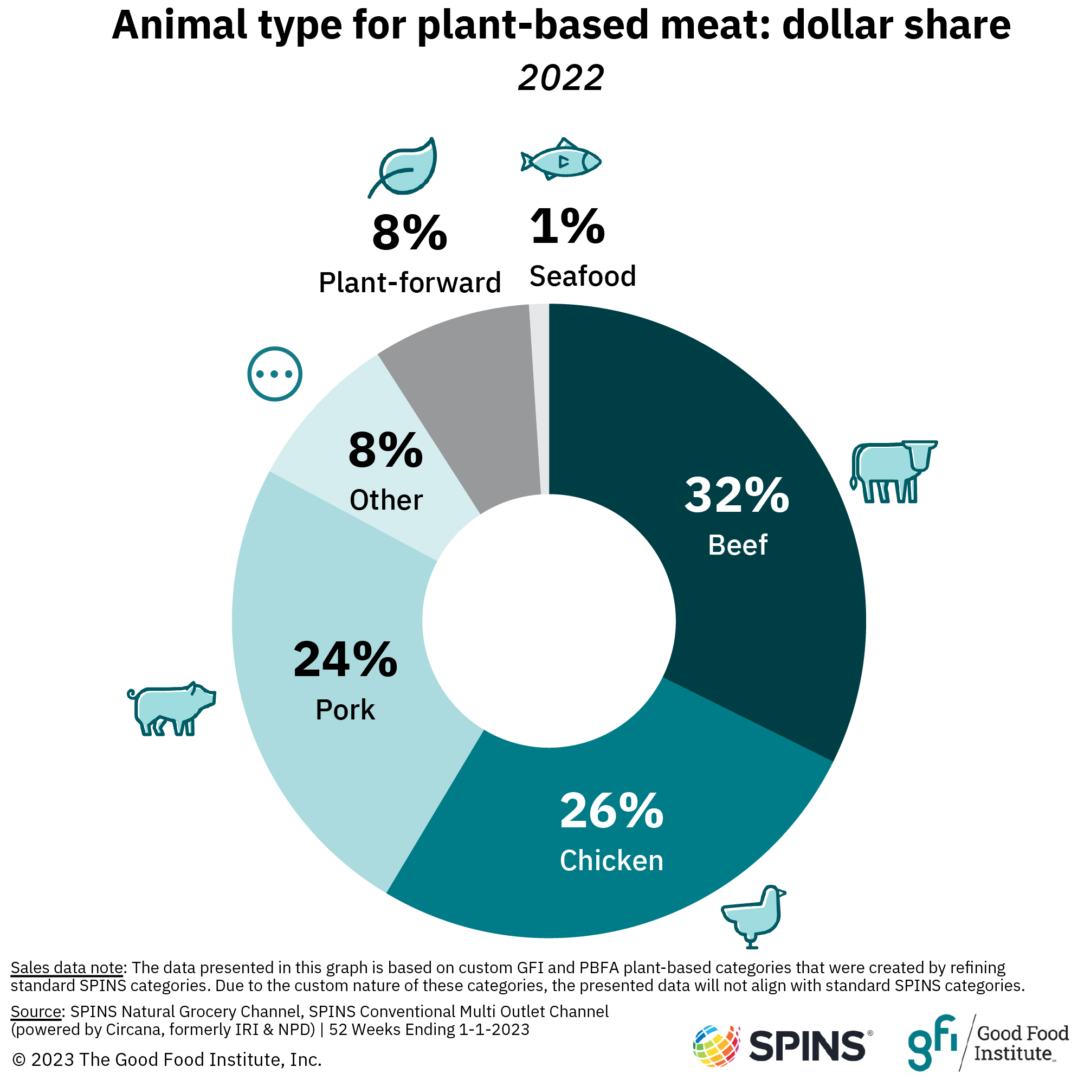

Animal type

- In terms of animal type, plant-based beef remains the largest subcategory by dollar sales, followed by plant-based chicken and pork.

- In 2022, plant-based chicken and seafood were the only major animal types with positive dollar sales growth.

- Plant-based chicken and seafood continued to see a high amount of innovation activity as more next-generation products that seek to match the taste, texture, and appearance of their animal-based counterparts were launched in U.S. retail.

Purchase dynamics

Household penetration and repeat purchase

- Opportunities exist to reach more households. Less than one in five households purchased plant-based meat in 2022, presenting a significant opportunity for products to reach new consumers.

- Most plant-based meat buyers are repeat purchasers. 63% of households purchasing plant-based meat made repeat purchases within the category. This rate was second only to plant-based milk (76%).

- Plant-based meat shoppers are major consumers of other plant-based categories. Of households that purchased both plant-based and conventional meat in 2022, 65% also purchased plant-based milk and 26% purchased plant-based ice cream and frozen novelties. This was higher than the baseline rates of total households purchasing in those categories, which was 41% for plant-based milk and 12% for plant-based ice cream, demonstrating the many consumers cross-purchase across multiple plant-based categories.

- Dollar sales per buyer for households that purchase both plant-based meat and animal-based meat is higher than for the average household. These households spent 19% more than the average household, and 21% more than an average household that purchases animal-based meat but not plant-based meat.

An opportunity: seafood spotlight

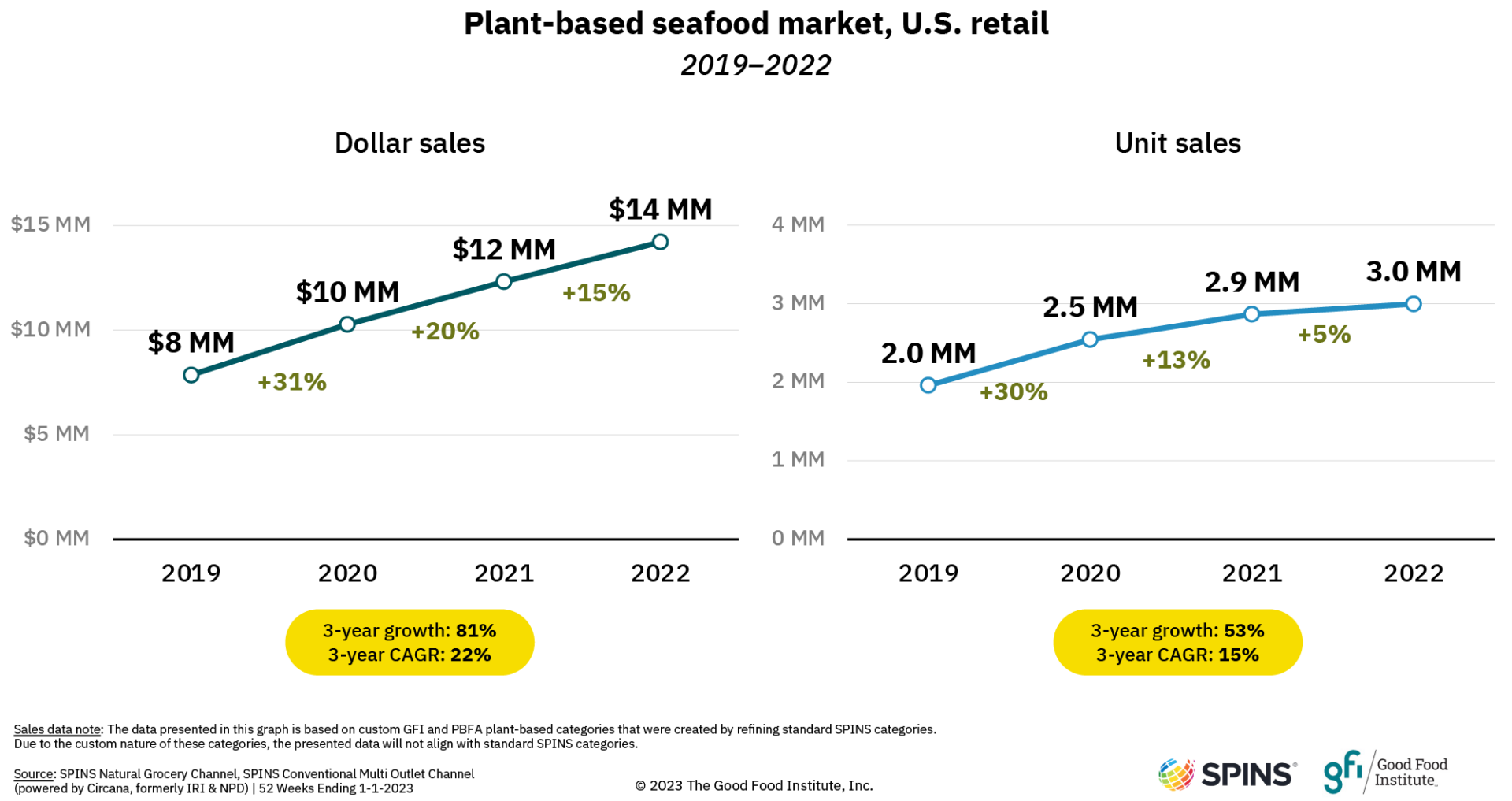

Plant-based seafood dollar sales increased by 15% in 2022 and unit sales grew 5%, outpacing total plant-based meat sales, yet remaining a small fraction of the total plant-based meat and seafood category.

Key insights

- From 2019 to 2022, plant-based seafood unit sales grew 53%—albeit on a small base, as several brands and products came to market or expanded distribution.

- The number of plant-based seafood products on retail shelves is increasing. In 2019, only 19 plant-based seafood items registered at least $10K in dollar sales in U.S. retail. In 2022, this number is at 33 as more products have come to market. In contrast, more developed categories like plant-based beef have hundreds of SKUs available in the marketplace—more options, at varied price points, merchandised across departments including the fresh meat case.

The dollar opportunity

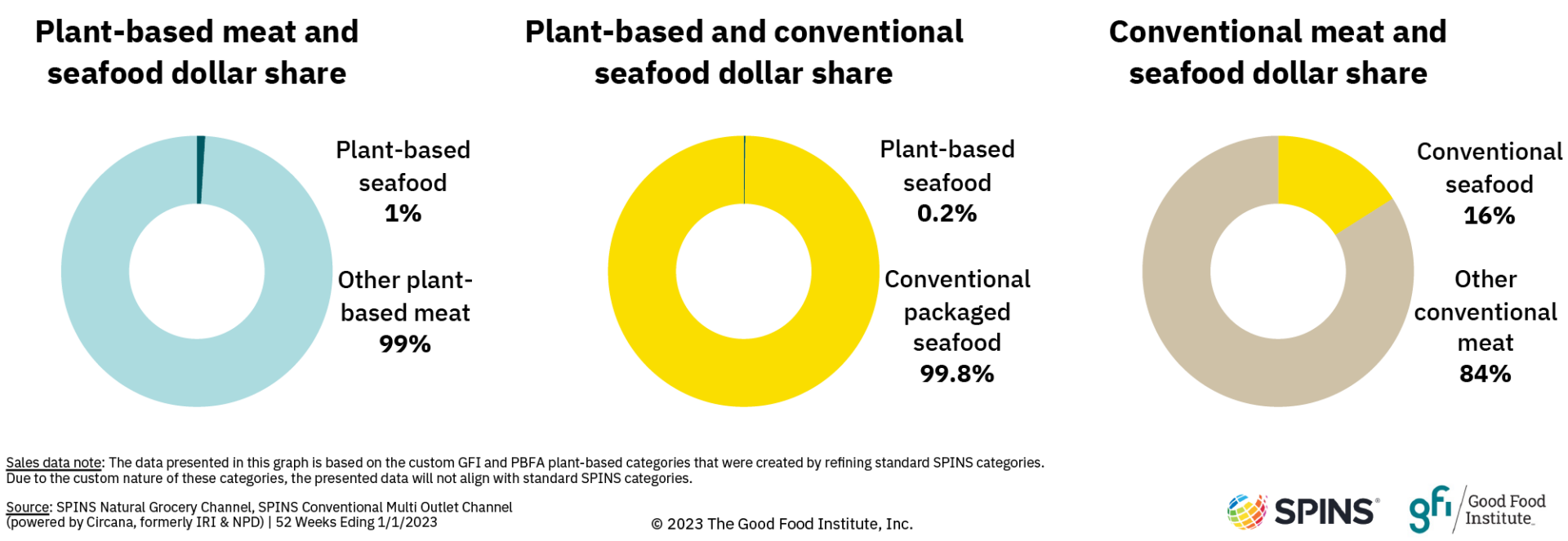

Plant-based seafood could be well poised to capitalize on the advancements made in the broader plant-based industry. While plant-based seafood composes 1% of total plant-based meat and seafood dollar sales, conventional seafood composes roughly 16% of total conventional meat and seafood dollar sales, demonstrating the significant white space that plant-based seafood represents. In U.S. retail in 2022, plant-based meat dollar sales made up 2.5% of total retail packaged meat dollar sales, while plant-based seafood dollar sales represented an estimated 0.2% of the retail dollar share amount of packaged seafood products, which are an $8.5 billion category, according to SPINS.

Retail plant-based seafood sales in the U.S. could grow by an estimated ~$200 million if the category were able to capture the same dollar share of the seafood market that plant-based meat represents in the packaged meat market. And because 65% of seafood sales in the U.S. occur in foodservice, the opportunity across the greater food sector is much greater.

For more insights on the alternative seafood commercial landscape, download our Industry Update: Alternative seafood.

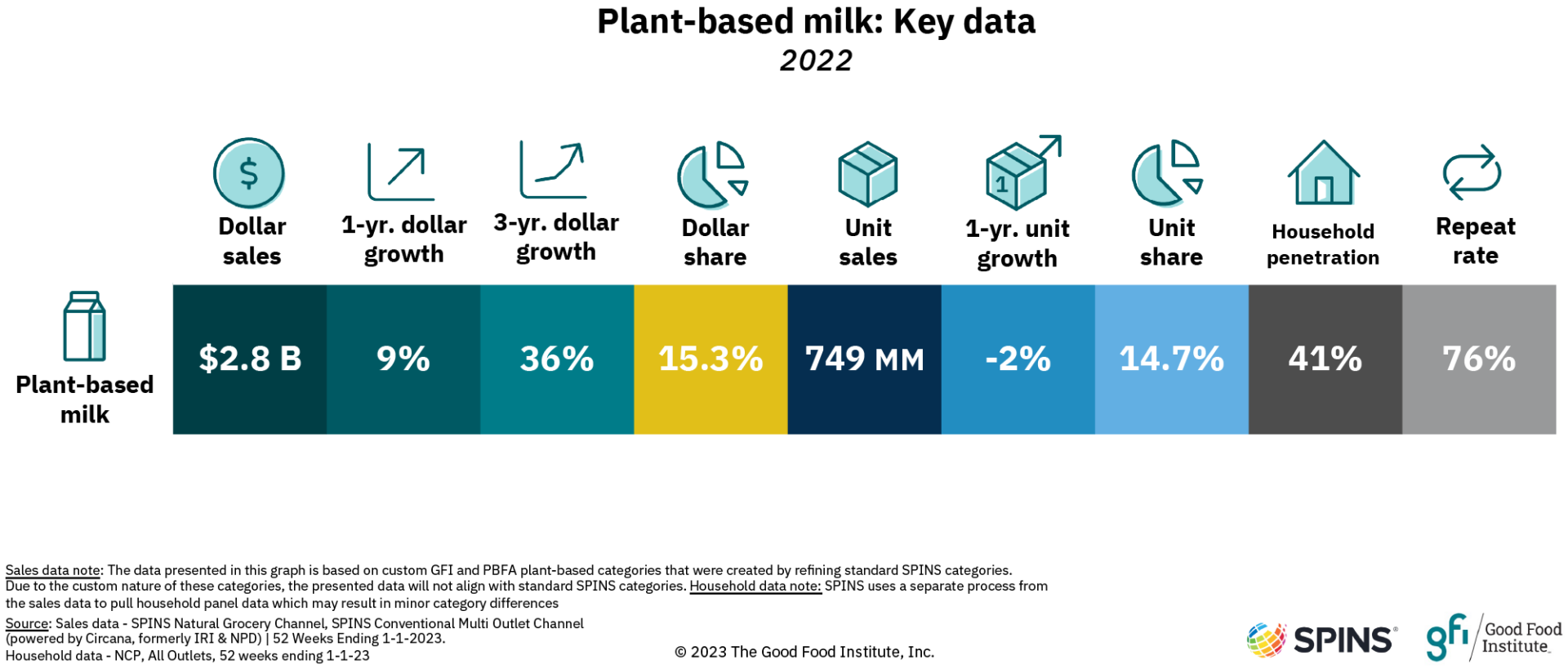

Plant-based milk market

The plant-based milk category is the most developed plant-based category, worth $2.8 billion. By dollar sales, plant-based milk alone accounts for 35% of the total plant-based food market.

Plant-based milk sales

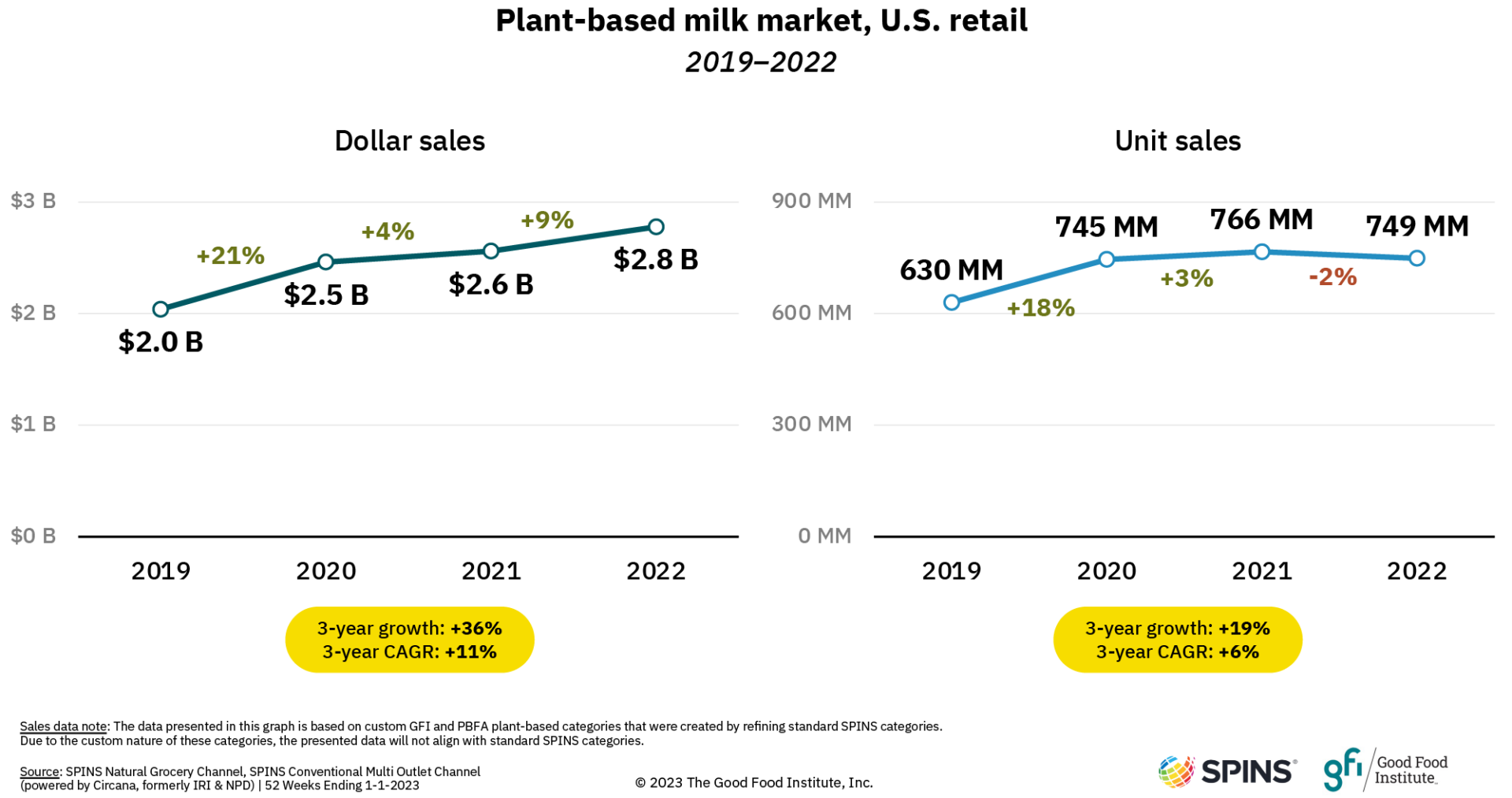

Plant-based milk is a sizable category accounting for 15 percent of all dollar sales of total milk in U.S. retail. In 2022, plant-based milk saw significant dollar sales growth while unit sales declined slightly, indicative of increased average prices-per-unit, in line with retail trends.

Plant-based milk serves as the innovation leader in the milk category, supported by key advancements in ingredient diversification and product development that seeks to replicate both the sensory experience and nutritional attributes of cow’s milk.

Key insights

- Plant-based milk has been a major growth engine of the overall milk category in the past several years. Plant-based milk unit sales grew 19% from 2019 to 2022, compared to animal-based milk, which saw unit declines of 4% over the same period.

- In 2022, plant-based milk’s dollar share held steady. Plant-based milk’s dollar share of the total milk category held flat from 2021 to 2022 at 15%. The plant-based milk category experienced price-per-unit increases consistent with other retail categories.

- In the natural channel, plant-based milk composes a sizable portion of the total milk category. Innovation often starts in the natural channel, where plant-based milk represents 42% of all milk sold by dollar sales.

- Households with young children and households with high income levels are more likely to spend more on the plant-based milk category. These demographic insights are consistent across 2021 and 2022.

Plant-based milk segment insights

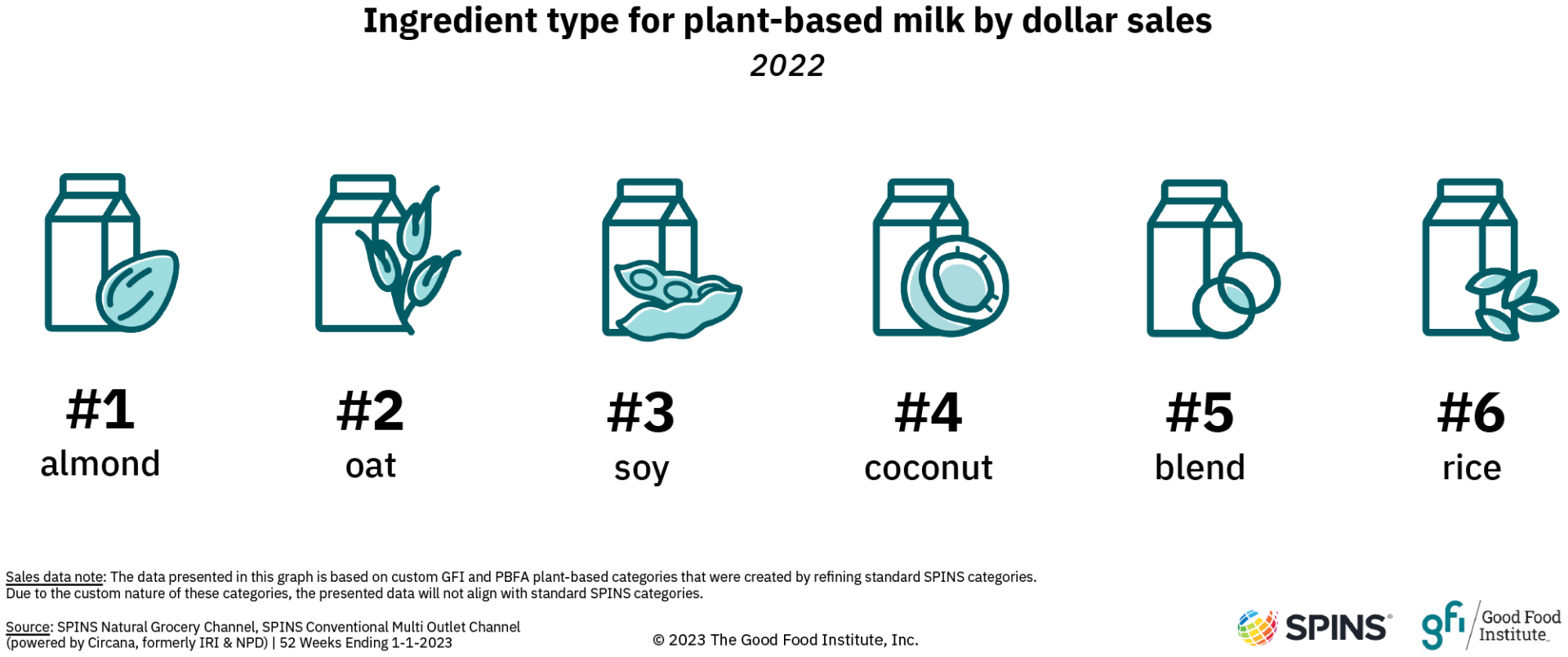

Ingredient base

- As the plant-based category with the greatest dollar sales, plant-based milk continues to benefit from product innovation and merchandising of the category adjacent to the conventional milk set.

- Almond milk is the largest subcategory by dollar sales, accounting for 57% of plant-based milk dollar sales.

- Oat milk has skyrocketed in dollar share over the last three years, growing from 4% of plant-based milk sales in 2019 to 22% in 2022. Oat milk was the top-growing plant-based milk segment in 2022 with dollar sales up 32% and unit sales up 20%.

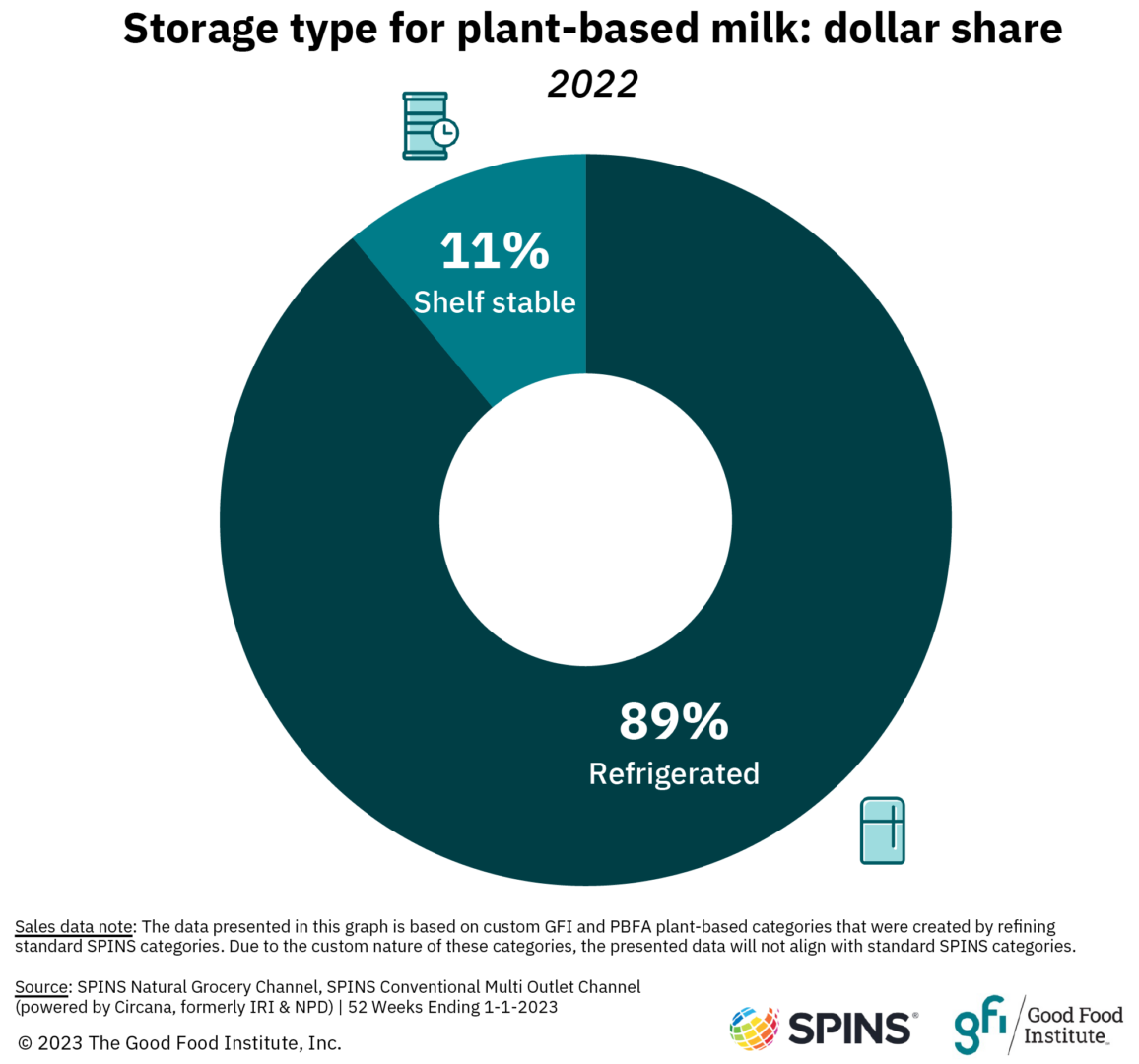

Refrigerated vs. shelf-stable

- Refrigerated plant-based milk continues to dominate the category, representing 89% of plant-based milk sales.

- Today, refrigerated milk is consistently shelved adjacent to animal-based milk. This has been critical to the rise of plant-based milk over the past decade to the 15% market share of total milk dollar sales it has today.

For more insights on how to leverage merchandising to best capitalize on the growing plant-based market, check out our merchandising guide.

Plant-based milk sales

Household penetration and repeat purchase

- The household penetration of plant-based milk held relatively steady in 2022. Plant-based milk is a major entry point for households trying products across plant-based categories. Plant-based milk is the leading plant-based category for the percentage of U.S. households purchasing, at 41%, down just one percentage point from 2021.

- Plant-based milk has the highest repeat rates of any plant-based category. 76% of households purchased in the plant-based milk category on more than one occasion in 2022.

The market for other plant-based dairy and eggs

Other plant-based dairy and egg categories are in various stages of maturation.

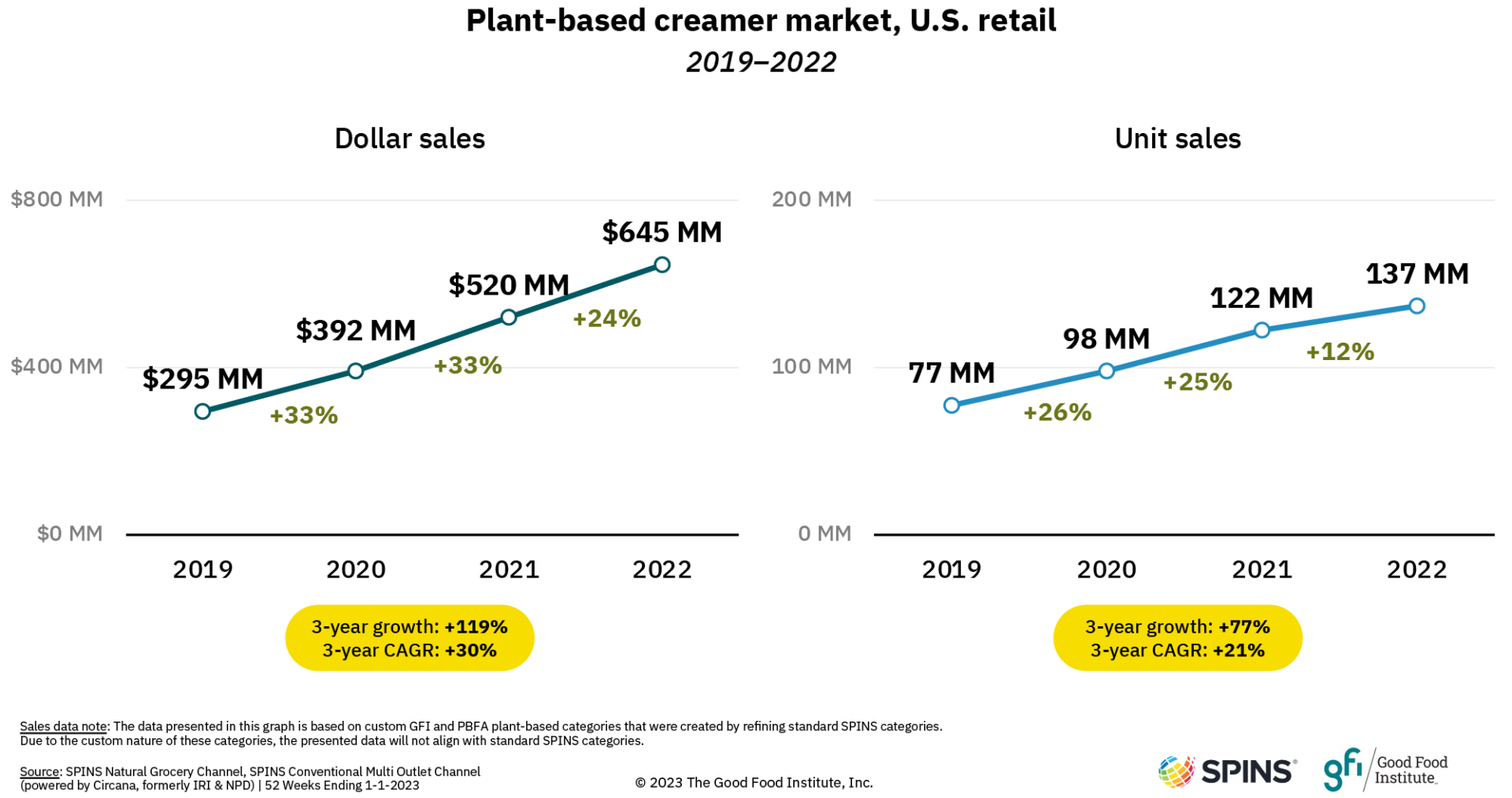

Creamer

The plant-based creamer category has experienced three consecutive years of strong dollar and unit growth as it gains share rapidly in the creamer market.

Key insights

- Since 2019, dollar sales of plant-based creamer have more than doubled and unit sales have nearly doubled. Plant-based creamer’s growth may have benefitted from product and ingredient similarities to plant-based milk, which is the most developed plant-based meat category and the one most consumers have the greatest familiarity with.

- Plant-based creamer’s market share of total creamer has increased to 12% of dollar sales in 2022. This is up from 7% in 2019 and slightly up from 11% in 2021.

- Plant-based creamer dollar sales growth is outpacing that of animal-based creamer. Plant-based creamer’s 3-year dollar sales growth (119%) is four times higher than that of animal-based creamer (25%), although plant-based growth is on a smaller base. The 3-year unit sales growth differential is also notable—77% for plant-based creamer compared to 5% for animal-based creamer.

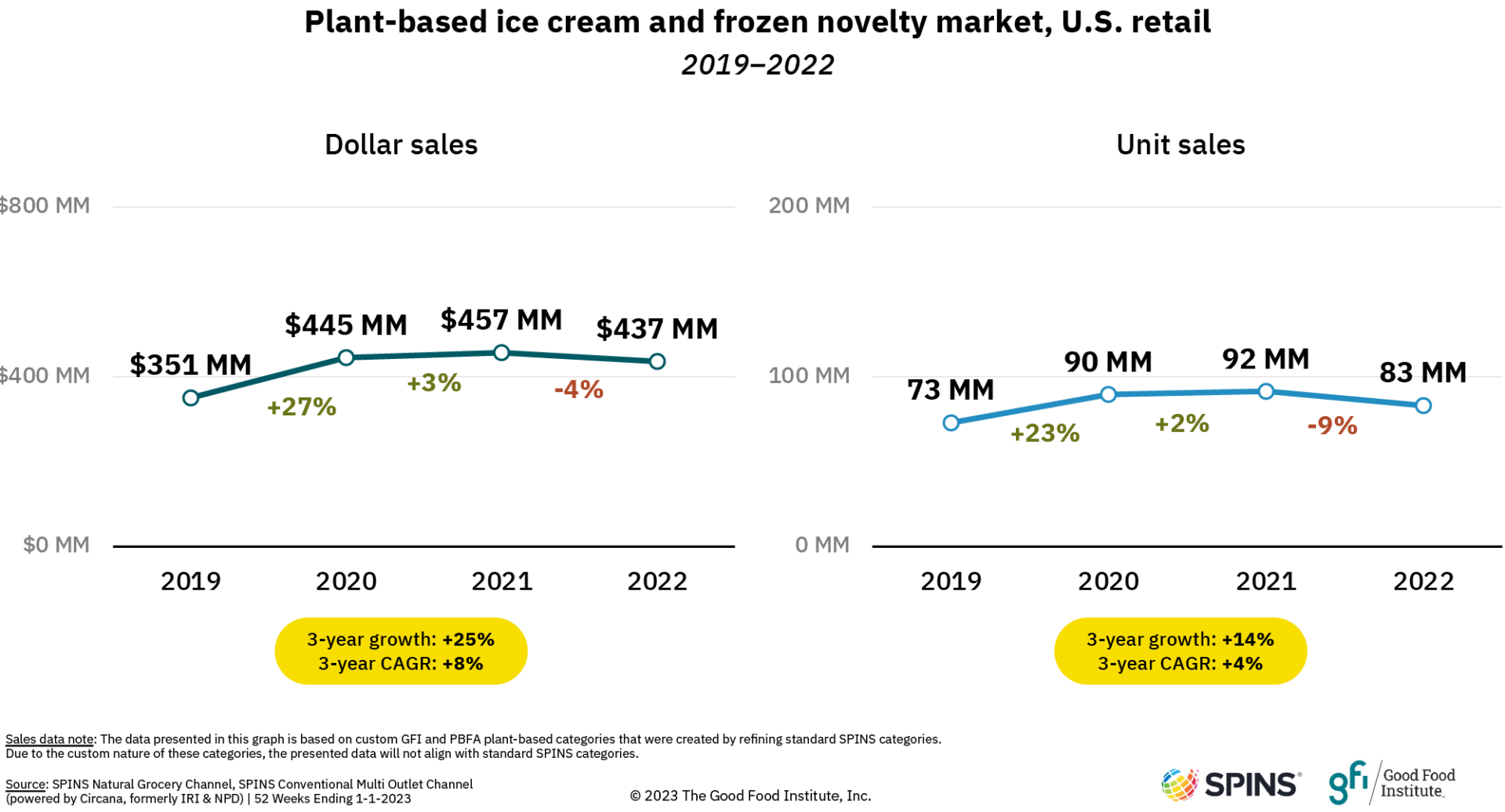

Ice cream and frozen novelty

The plant-based ice cream and frozen novelty category experienced declining dollar and unit sales in 2022.

Key insights

- For plant-based ice cream and frozen novelty, unit sales declines of 9% have outpaced dollar sales declines of 4%, indicating price-per-unit increases. Price increases were also the trend for animal-based ice cream in 2022, with unit sales down 3% and dollar sales up 8%.

- Plant-based ice cream is in a unique category position—it has the opportunity to tap into consumer desire for indulgence while offering consumers a product with better-for-you associations as a plant-based product. The average American eats 23 pounds of ice cream and frozen desserts each year. Notably, American consumers often report turning to indulgent products like ice cream during tough economic times.

- Companies are testing out new bases. Similar to the plant-based milk category, plant-based ice cream and frozen novelty have seen diversification of ingredient bases—like oat—in recent years.

- Plant-based ice cream and frozen novelties were purchased by one in 10 U.S. households in 2022. This category holds the third highest rate of household penetration (12%) among tracked plant-based categories behind milk and meat.

- Younger consumers are more likely to be plant-based ice cream buyers. Millennials are more likely to buy and spend more than other generations in the category. Notably, the plant-based ice cream category has democratized somewhat in the last year, as a higher proportion of lower-income households have increased their engagement in the category.

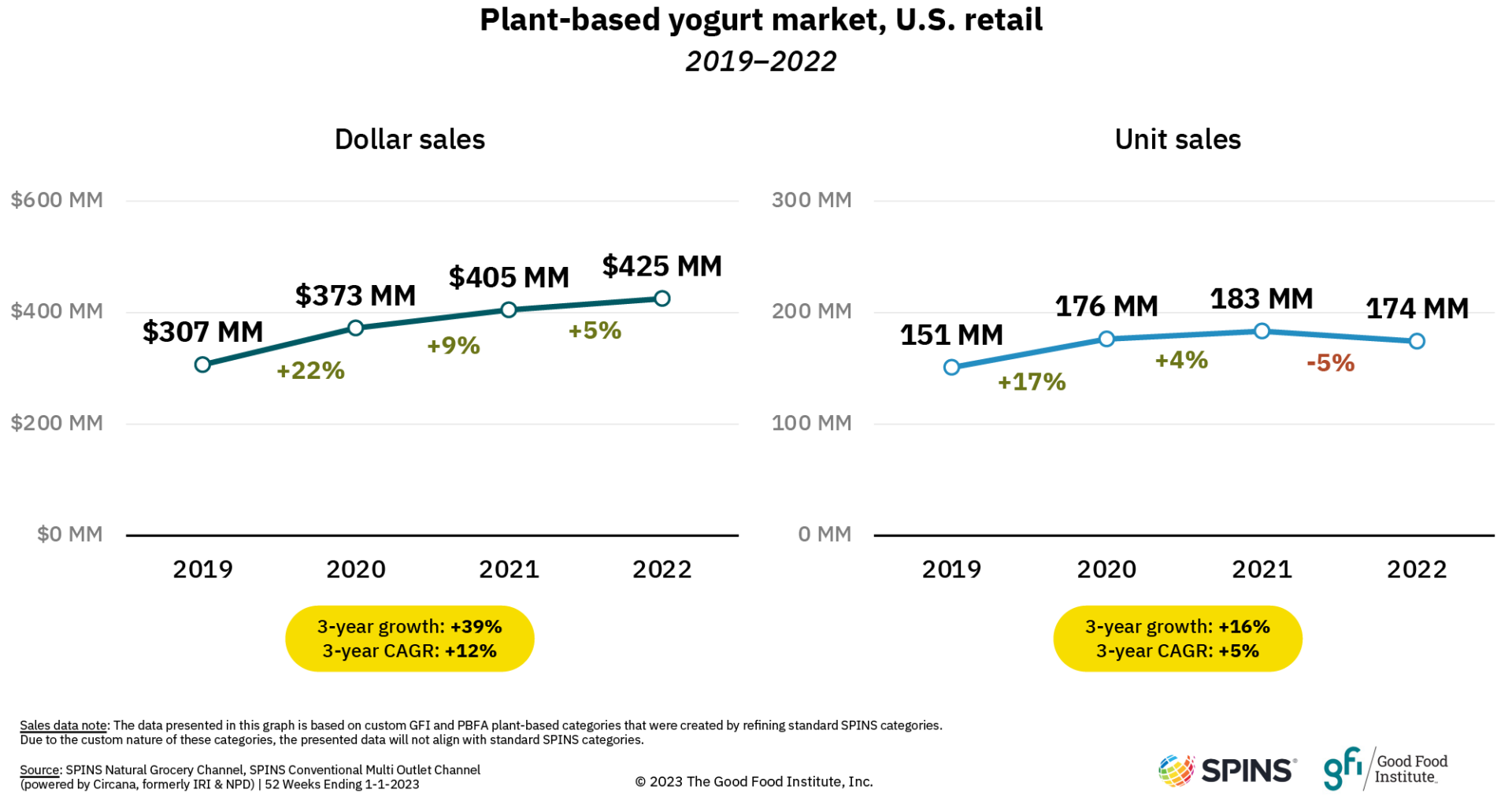

Yogurt

Plant-based yogurt dollar sales growth increased in 2022, while unit sales declined.

Key insights

- Household penetration of plant-based yogurt remains an opportunity. The percentage of U.S. households purchasing plant-based yogurt was 9% in 2022, down two percentage points from 2021.

- Category repeat rates have increased. Despite a decline in penetration, repeat rates within the category have grown slightly each of the last three years, reaching 55% in 2022, up from 50% in 2019.

- Plant-based yogurt’s market share of total yogurt has remained relatively steady. In 2022, plant-based yogurt composed 4.5% of dollar sales of the total yogurt market and had a similar share of total unit sales.

- Plant-based yogurt unit sales declines are on par with animal-based yogurt’s rate of unit decline. Plant-based yogurt unit sales declined in 2022 at the same pace as those of animal-based yogurt, and off a smaller base. Animal-based yogurt experienced greater dollar sales growth, indicating higher average price-per-unit increases than plant-based yogurt.

- Younger consumers and households with young children are more likely to buy and spend more on plant-based yogurt. Lower-income households are less likely to purchase plant-based yogurt, which may present an opportunity to increase consumer engagement by making products more accessible and affordable.

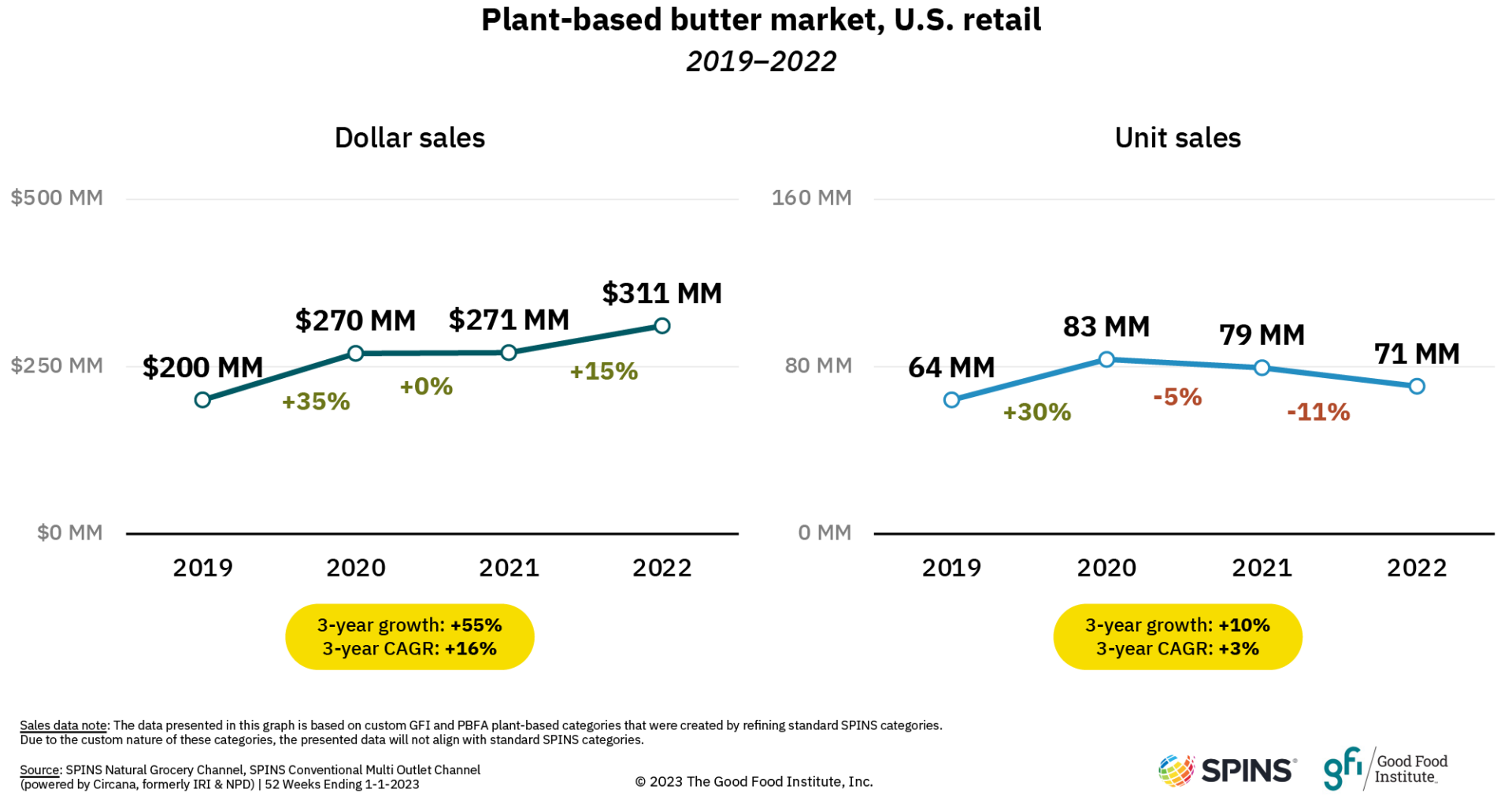

Butter

Plant-based butter saw unit declines in 2022, while dollar sales increased.

Key insights

- Unit sales of plant-based butter have lagged dollar sales. In the last three years, plant-based butter unit sales have grown 10% while dollar sales are up 55%.

- Plant-based butter’s market share of total butter has decreased slightly. In 2022, plant-based butter composed 5% of dollar sales as well as 5% of unit sales for the total butter market, both similar to the prior year.

- Plant-based and animal-based butter prices have increased dramatically. Compared to 2021, the average price per unit of plant-based butter grew 29%, a growth rate slightly higher than that of animal-based butter, which grew 26%.

- As defined in this data set, the plant-based butter category is dominated by vegetable oil-based margarines and spreads. However, the last few years have also seen the launch and growth of several products more directly positioning themselves as plant-based butter products.

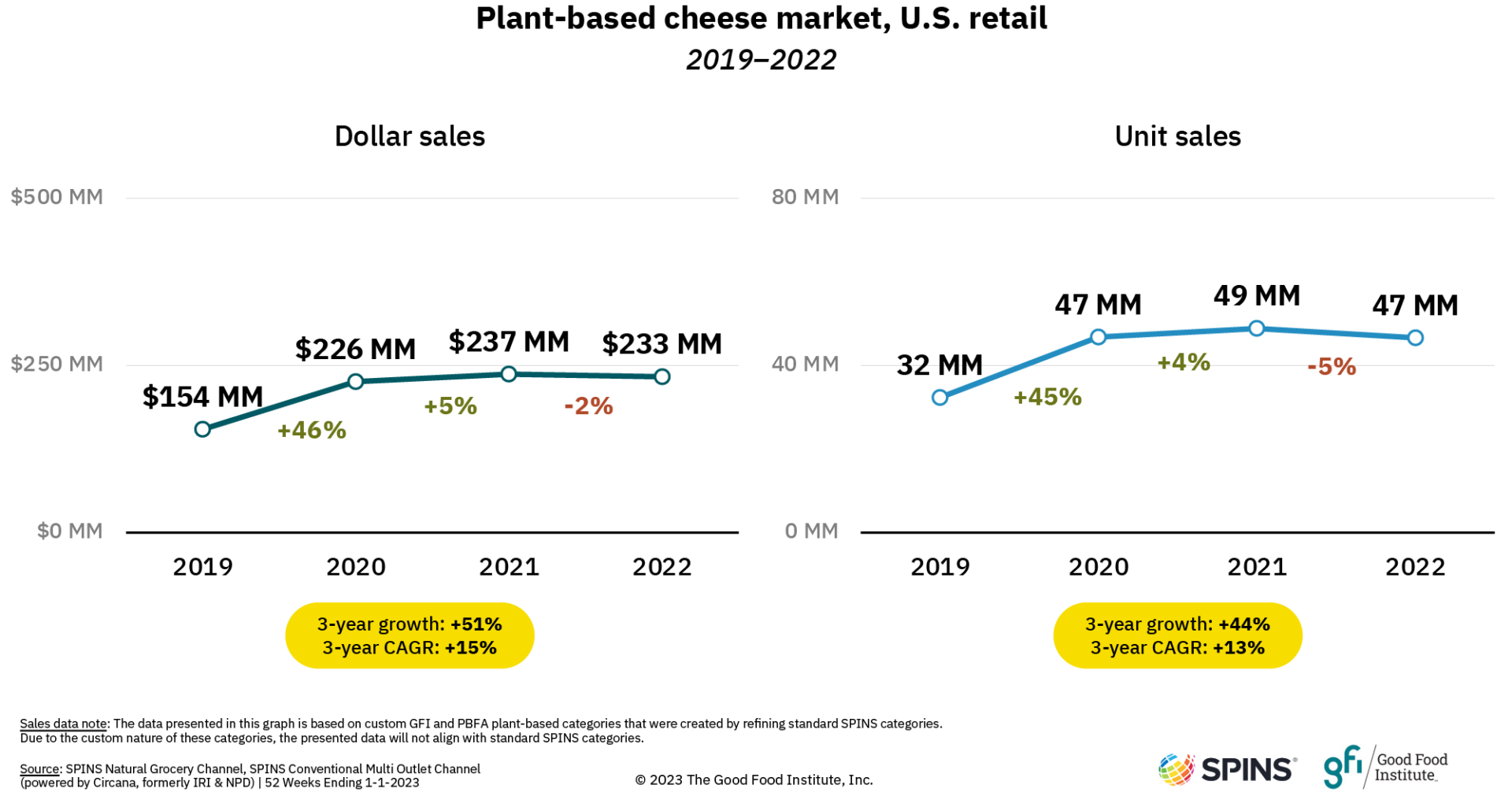

Cheese

Both dollar and unit sales declined for the plant-based cheese category in 2022 after significant growth in the previous two years.

Key insights

- Household penetration of plant-based cheese is small but has seen modest growth over the last three years. The percentage of households purchasing plant-based cheese rose to 5% in 2022 (similar to in 2021) compared to just 3% of households purchasing in the category in 2019.

- Repeat rates are down by seven percentage points from 2020, indicating more opportunities for product development to meet consumer needs. The percentage of buyers purchasing in the plant-based cheese category more than once decreased from 57% in 2020 to 50% in 2022.

- Plant-based cheese’s market share of total cheese dollar sales has remained steady. Plant-based cheese’s dollar sales share of the total cheese market has remained at about 1% over the last three years. Its unit share is just shy of 1%.

- Older Millennials and Gen X buyers are more likely to spend more on plant-based cheese. While households with younger and older children are more likely to spend more on animal-based cheese, this is not the case for plant-based cheese, indicating an opportunity to increase engagement with families.

- The animal-based cheese category has high consumer engagement, offering a large potential market. Behind animal-based meat, animal-based cheese is the animal-based category with the greatest household penetration in the U.S., at 96%. Earning more of those households as plant-based cheese buyers represents a large opportunity for the plant-based cheese category. However, research shows that only a small portion of consumers say that plant-based cheese tastes as good as conventional cheese, indicating further innovation and engagement opportunities to increase consumer activity in the category.

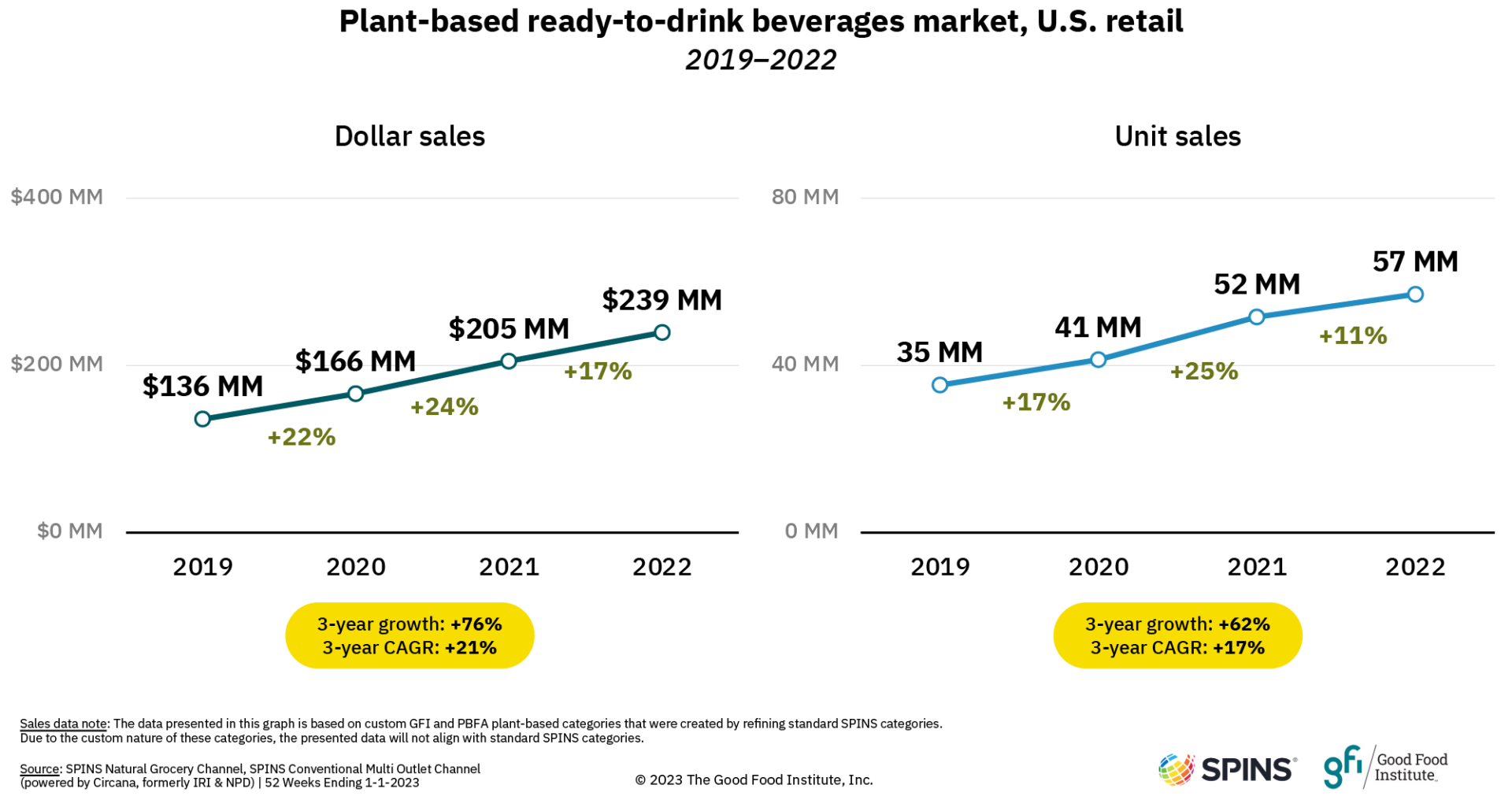

Ready-to-drink beverages

As several ready-to-drink beverage product types grow, consumers are seeking out plant-based as a key attribute in the category. Plant-based replacements for ingredients like milk or creamer used in ready-to-drink lattes, nitro coffee brews, and teas are examples of the plant-based trend intersecting with an uptick in consumer interest in ready-to-drink beverages.

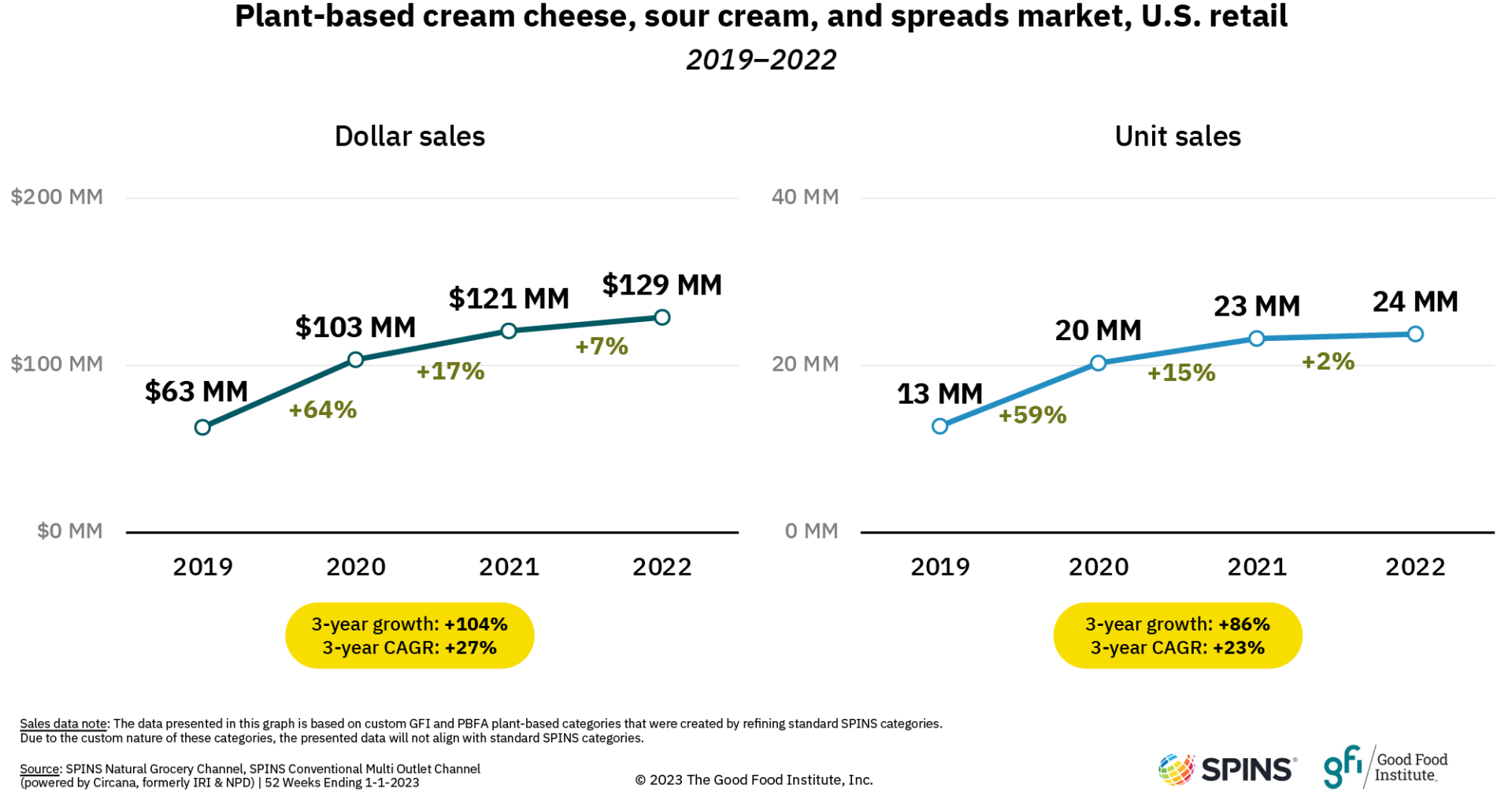

Cream cheese, sour cream, and spreads

Plant-based cream cheese, sour cream, and spreads have been one of the fastest-growing plant-based categories by unit sales over the past three years, second only to plant-based eggs. Dollar sales have doubled since 2019. Consistent with other plant-based categories, sales slowed in 2022 and dollar growth outpaced unit growth.

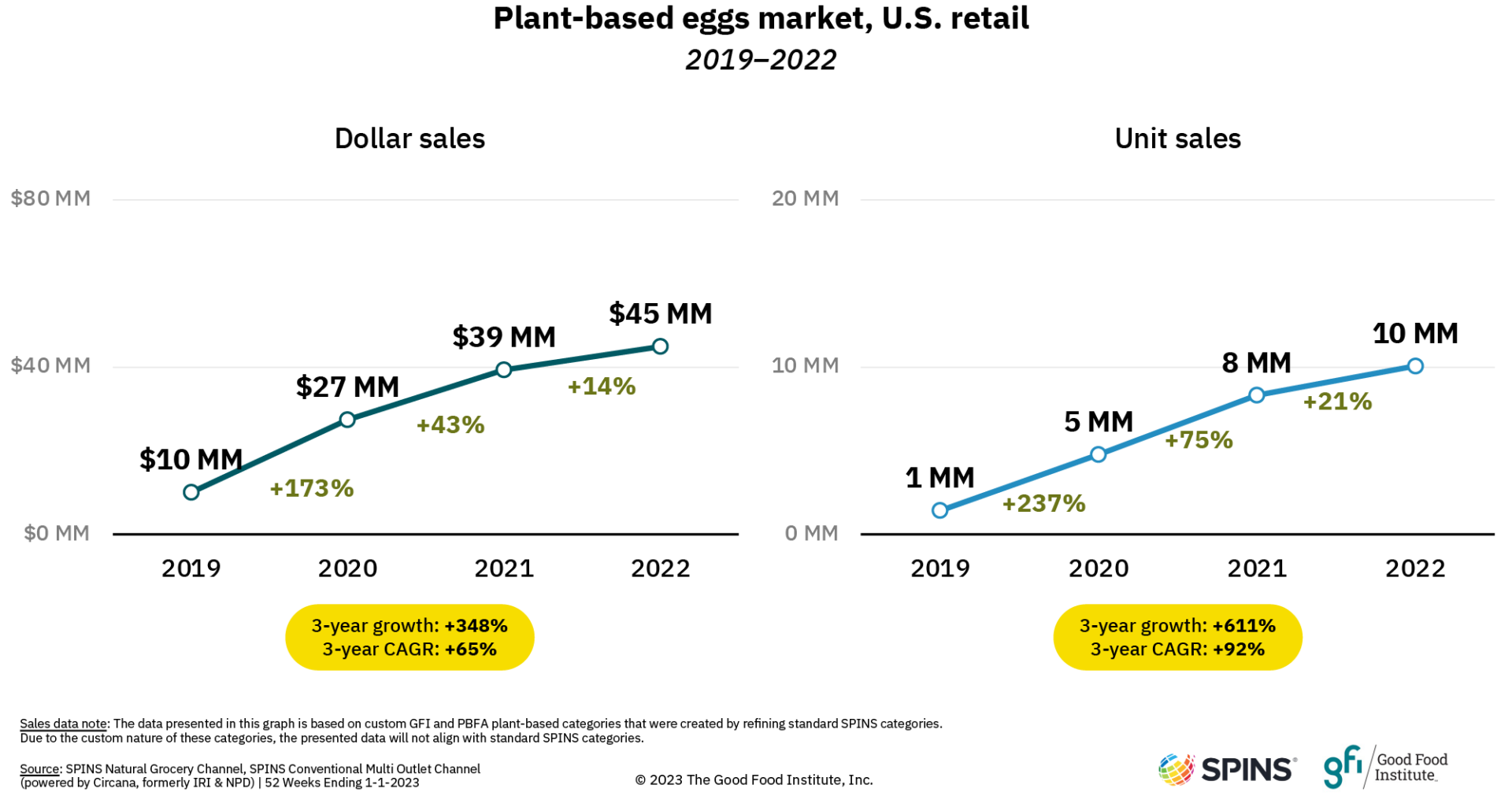

Eggs

The plant-based egg category is modest in size, yet growing at an exceptionally rapid rate—the fastest of any plant-based category, although on a relatively small base.

Key insights

- Household penetration of plant-based eggs is very small as the category emerges. The percentage of U.S. households purchasing plant-based eggs was just under 2% in 2022, presenting a massive runway for the category to continue growing.

- Repeat rates increased dramatically from 2021 to 2022. The percentage of buyers purchasing in the plant-based eggs category more than once in the year increased by five points in 2022 to reach 45%. This increase is even more significant compared to 2019 when just 20% of plant-based egg-purchasing households bought in the category more than once.

- Unit sales of plant-based eggs have also increased. Plant-based egg unit sales have grown 7x since 2019, from 1.4 million in 2019 to more than 10 million units in 2022. For reference, animal-based egg unit sales were ~2.3 billion in 2022.

- The category’s share of total egg dollar sales remains small. Plant-based eggs composed 0.5% of dollar sales for the total egg market in 2022, up from 0.2% in 2019.

- Plant-based egg dollar growth is outpacing that of animal-based eggs, although on a much smaller base. In the last three years, while the plant-based egg market has emerged quickly, the conventional egg market saw 67% dollar sales growth driven by extreme price increases, along with a notable 5% decrease in unit sales.

- The plant-based egg category made notable progress toward price parity in 2022. In 2021, plant-based eggs cost about $5 more per pound than animal-based eggs. This gap shrank to $3.50 in 2022, driven primarily by animal-based egg price increases and secondarily by decreases in plant-based egg prices.

- Gen X and younger Millennials are more likely to purchase plant-based eggs. African American consumers and consumers with postgraduate education are also more likely to purchase plant-based eggs.

Other plant-based foods

Additional plant-based food categories such as meals; protein liquids and powders; bars; tofu, tempeh, and seitan; condiments, dressings, and mayo; and baked goods provide additional options to consumers seeking more ways to add plant-based foods to their diets.

photo credit: Mind Blow

Plant-based meals

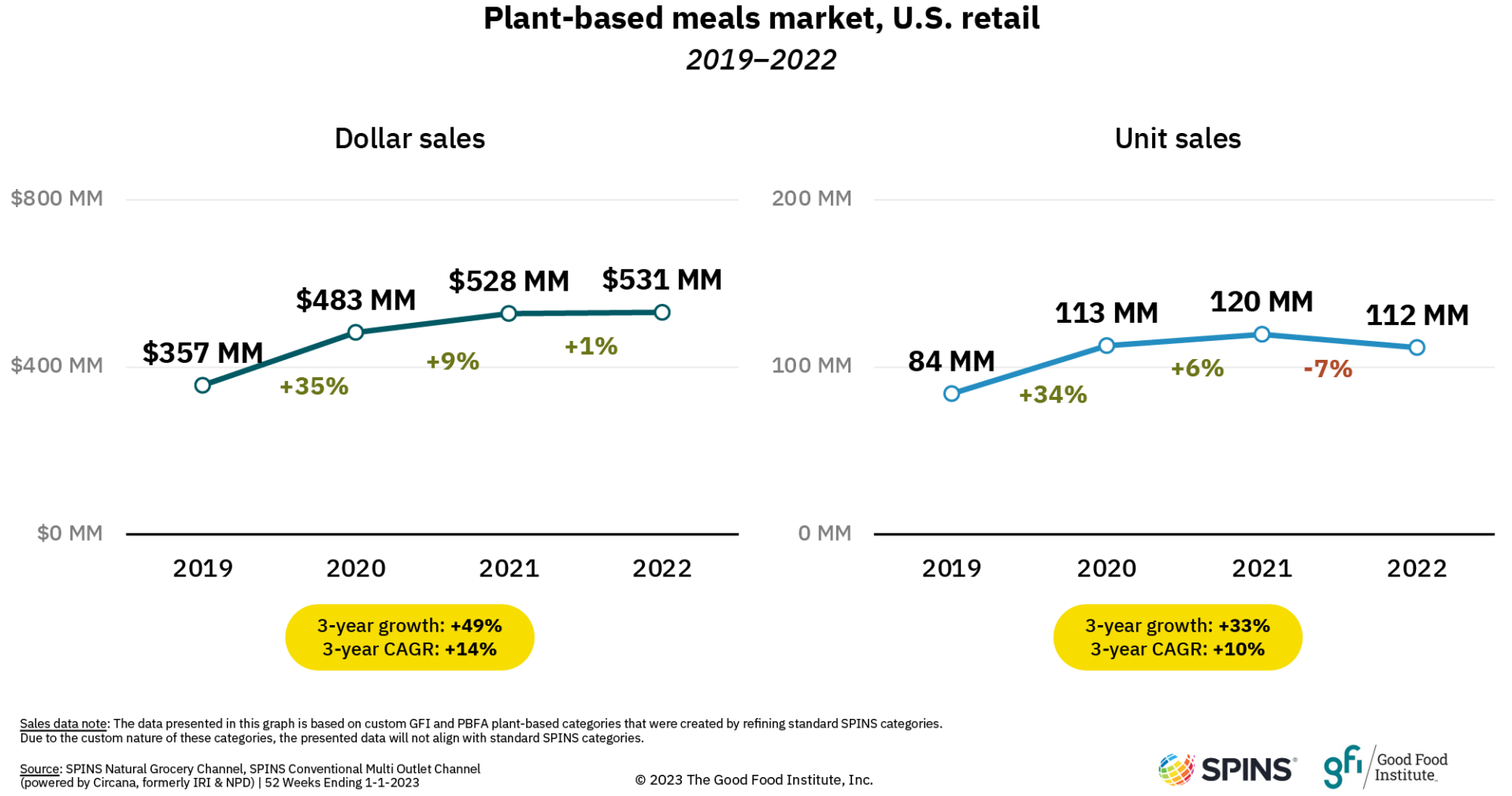

The plant-based meals category saw a familiar trend of dollar sales growth partnered with unit sales declines in 2022 despite significant growth in previous years. Incorporating plant-based meat, egg, and dairy ingredients into ready-to-eat meals is an important prong of providing customers with convenient meal solutions that meet their needs.

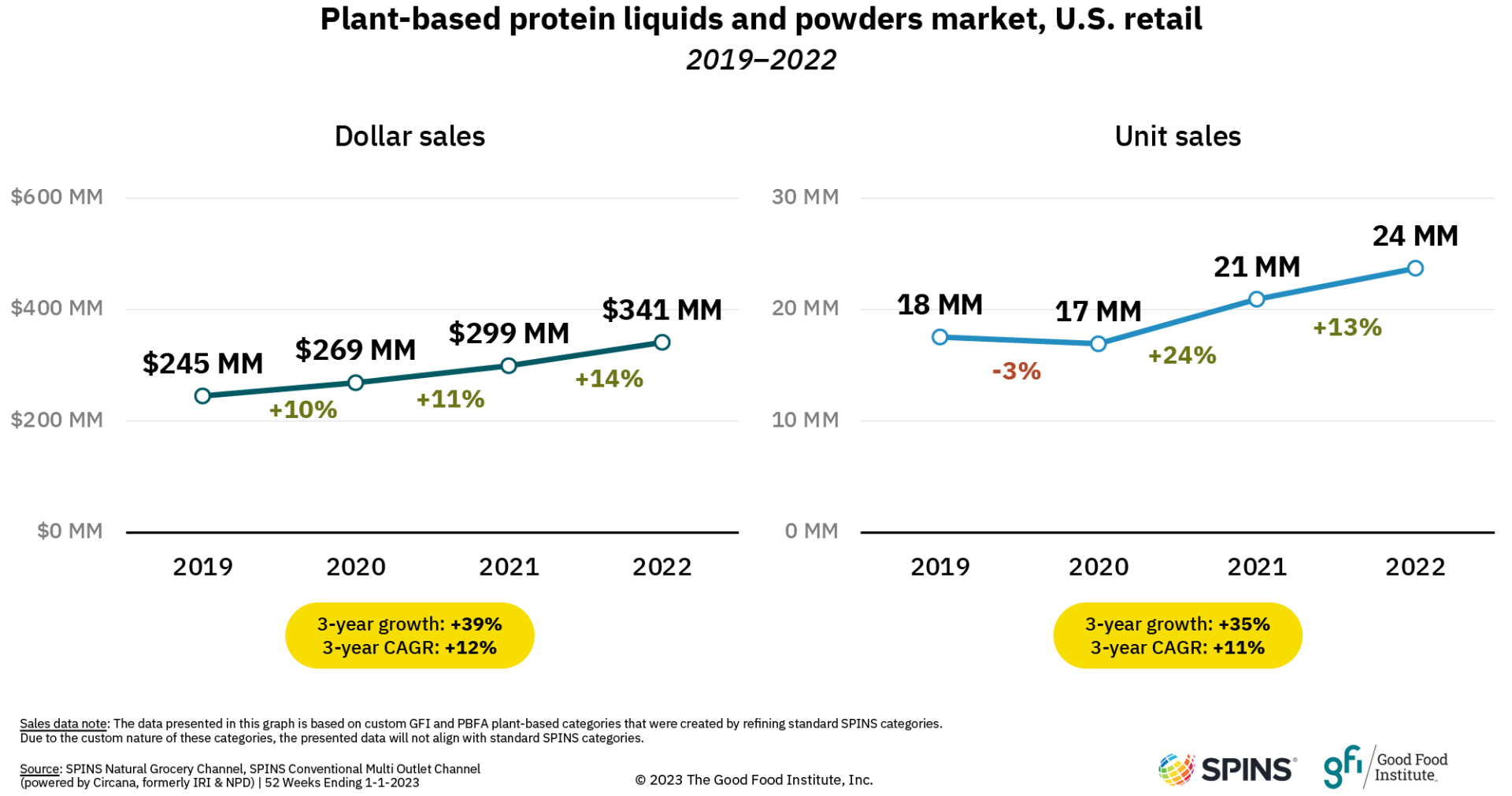

Plant-based protein liquids and powders

With the rise of the better-for-you trend, plant-based protein liquids and powders are experiencing steady growth as consumers seek diverse ways of adding high-protein, functional nutrition to their diets. In the natural channel, plant-based protein liquids and powders represented nearly 40% of dollar sales for total protein liquids and powders.

Plant-based protein bars

Plant-based bars have been on a three-year unit sales decline. Dollar volumes appear to be held up by significant per-unit price increases over the last two years.

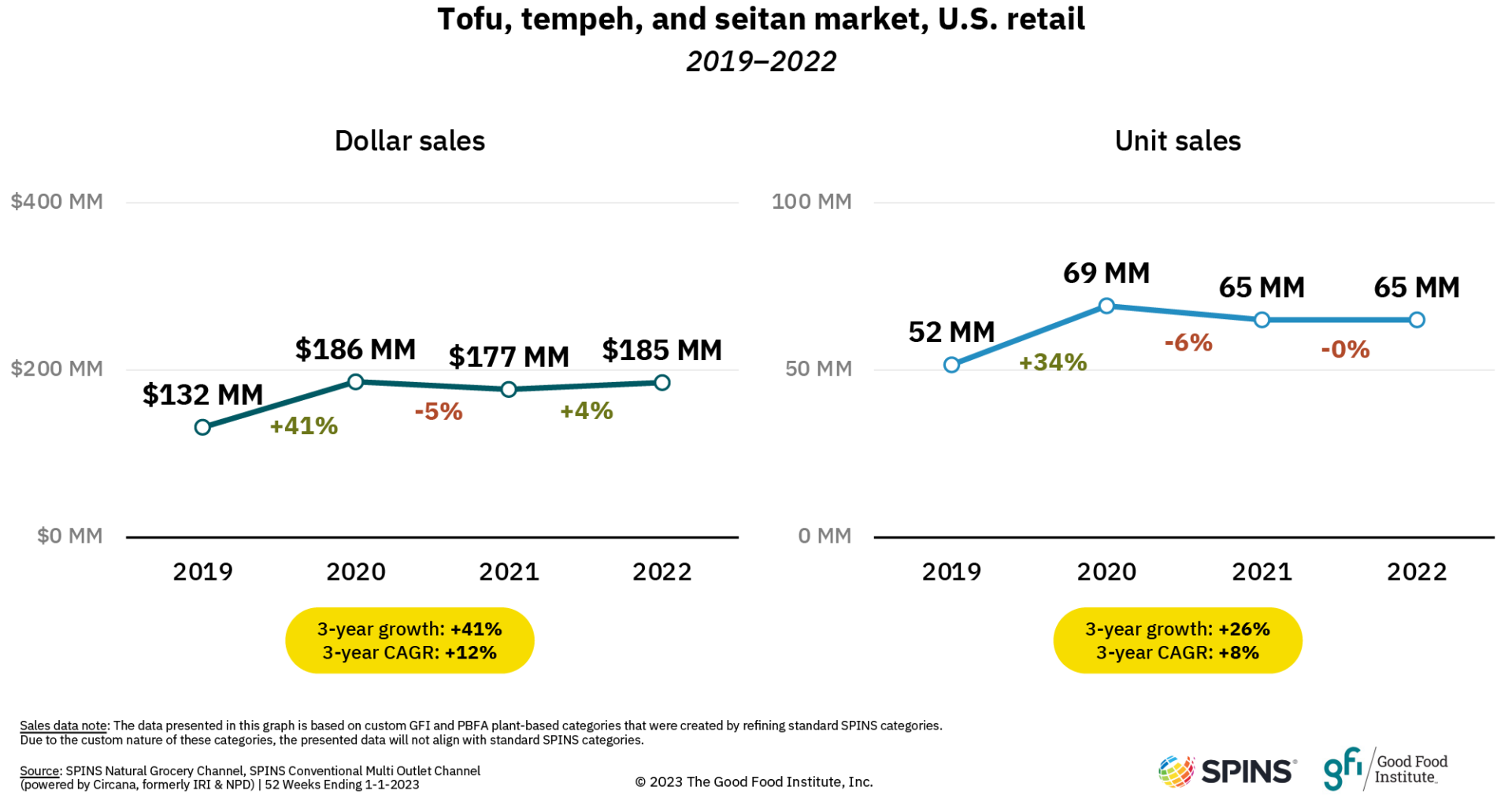

Tofu, tempeh, and seitan

The tofu, tempeh, and seitan category saw flat unit sales growth while dollar sales grew 4% in 2022. Like other food categories, the year 2020 was an especially impactful growth year and sales are yet to return to those highs.

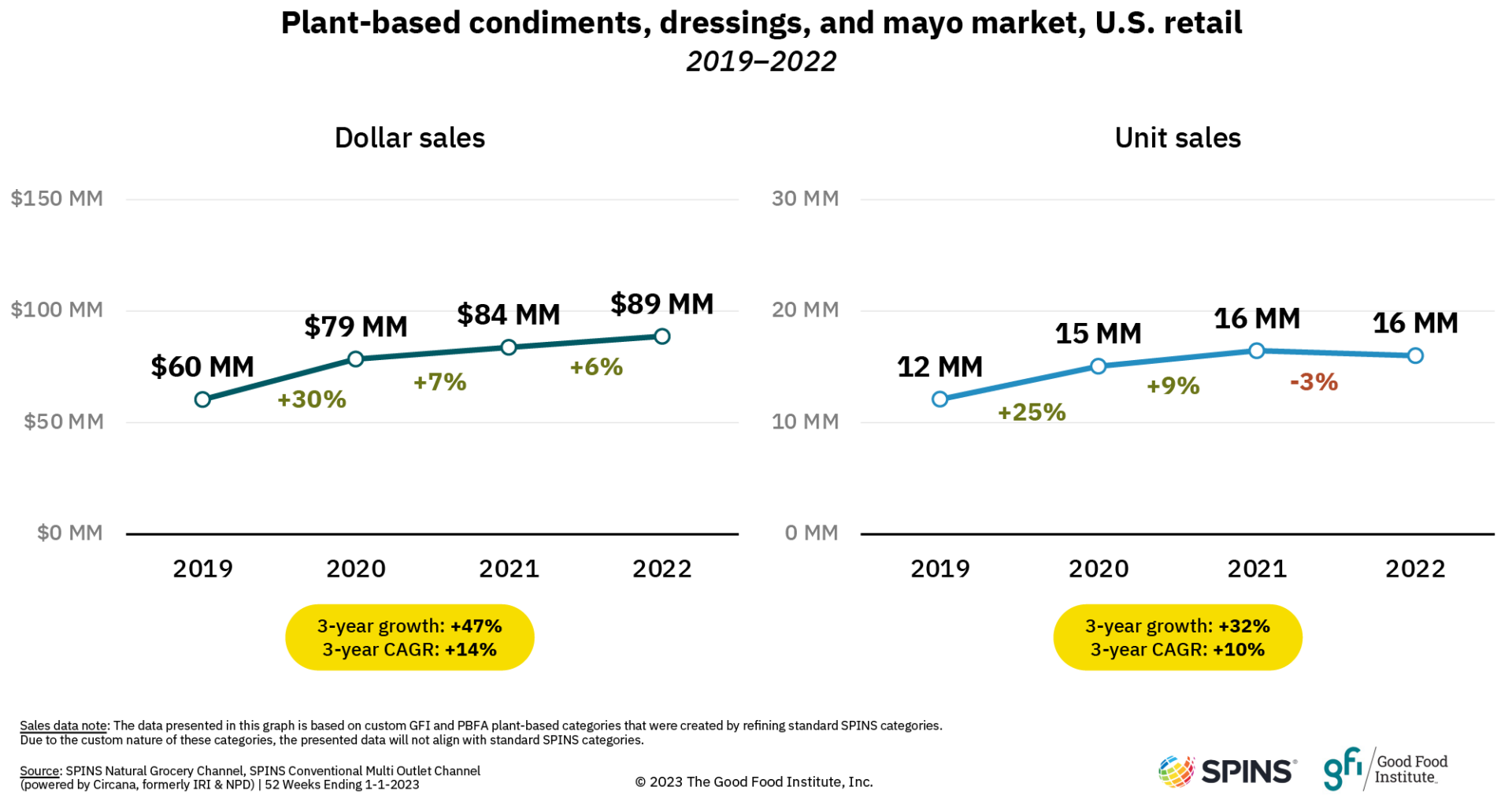

Condiments, dressings, and mayo

Similar to other categories, dollar sales of plant-based condiments, dressings, and mayo grew in 2022. However, unit sales declined slightly after two years of growth.

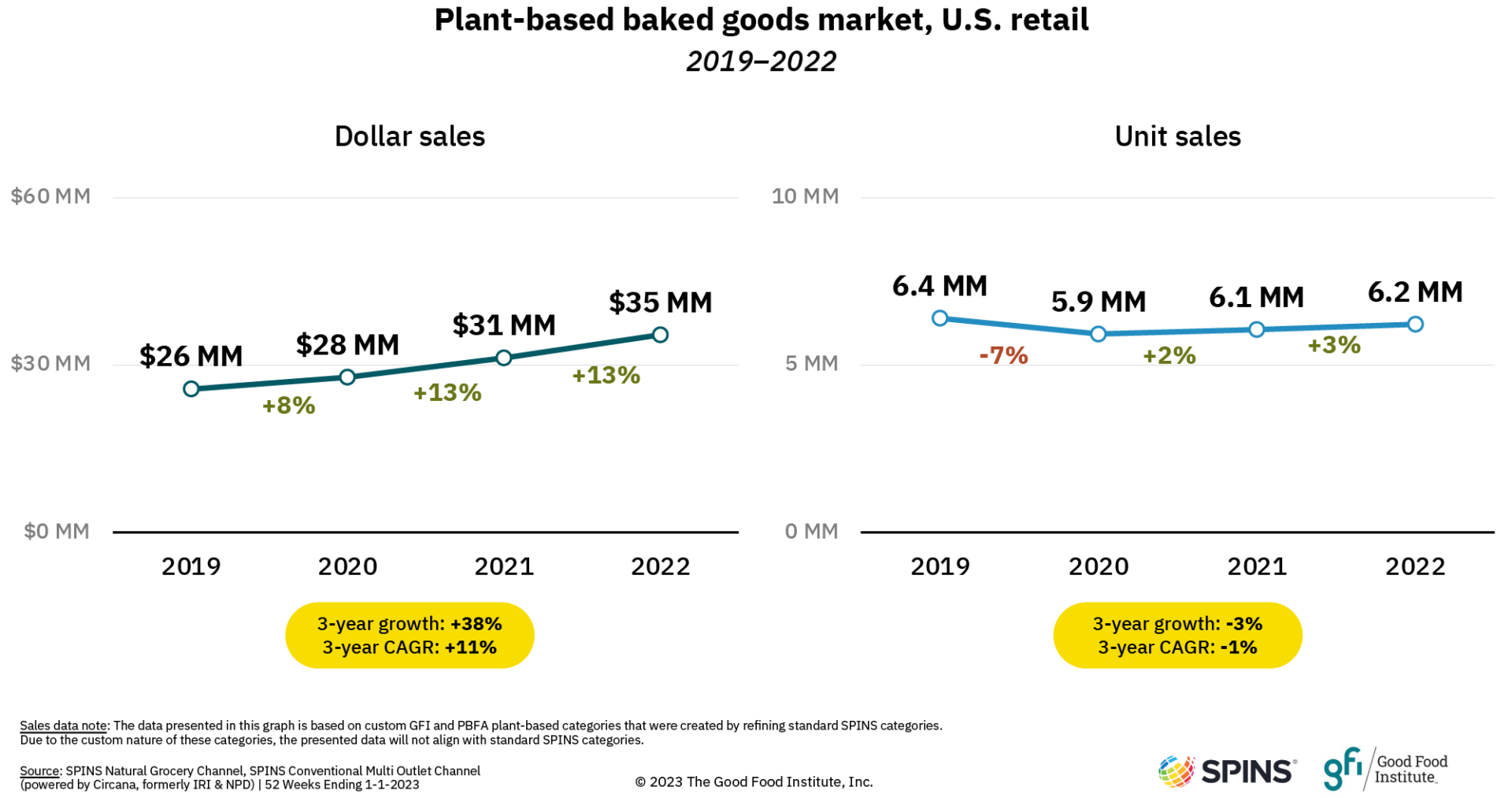

Baked goods

A new category captured in this year’s data, plant-based baked goods saw double-digit dollar sales growth in the past two years alongside more modest unit sales increases.

About the data

Point-of-sale data

To size the U.S. retail market for plant-based foods, GFI and PBFA commissioned retail sales data from the market research firm SPINS. The firm built the dataset by first pulling in all products with the SPINS “plant-based positioned” product attribute. The dataset was further edited by adding plant-based private-label products. Inherently plant-based foods, such as chickpeas and kale, are not included. Due to the custom nature of these categories, the retail data presented on this page may not align with standard SPINS categories. Additionally, SPINS pulled in relevant mainstream subcategories (excluding plant-based positioned products) in order to create the conventional categories discussed above. Finally, the total edibles category was pulled bringing in all grocery, frozen, and refrigerated edible items across the retail grocery landscape as well as protein powders and bars. SPINS obtained the data over the 52-week, 104-week, 156-week, and 208-week periods ending January 1, 2023, from the SPINS Natural Grocery Channel and Conventional Multi-Outlet Channel (powered by Circana, formerly IRI & NPD). SPINS defines these channels as follows:

Conventional Multi Outlet (MULO): More than 110,000 retail locations spanning the grocery outlet, the drug outlet, and selected retailers across mass merchandisers, including Walmart, club, dollar, and military.

Natural Enhanced: More than 1,900 full-format stores with $2 million+ in annual sales and 40% or more of UPC-coded sales from natural/organic/specialty products.

This is generally considered the broadest available view of retail food sales, although not all retailers are represented. Some companies, such as Whole Foods Market, Trader Joe’s, and Costco, do not report their scan data to SPINS or Circana (formerly IRI & NPD). Please note that this methodology has changed compared to that used in previous reporting by GFI. We do not recommend comparing data released in prior years to the data included here.

Consumer panel data

To understand consumer purchasing dynamics and demographics, GFI and PBFA also commissioned consumer panel data from SPINS. The process for pulling the panel data was separate from that for the POS data, which may result in minor category differences. SPINS acquires its panel data through the National Consumer Panel, a Nielsen and Circana (formerly IRI & NPD) joint venture composed of roughly 100,000 households. SPINS obtained the data over the 52-week, 104-week, 156-week, and 208-week periods ending January 1, 2023, from all U.S. outlets.

About SPINS

SPINS connects shopper values to product innovation by combining POS data across the conventional, eCommerce, and natural channels with deep product knowledge. By translating product data into attributes, we ensure retailers, brands, and their partners know just as much about the products they create, stock, and sell as the shoppers that buy them. These attributes create a common language that promotes collaboration and growth across the ecosystem.

Meet the authors

Emma Ignaszewski

ASSOCIATE DIRECTOR, INDUSTRY INTELLIGENCE & INITIATIVES

Emma Ignaszewski oversees the corporate engagement team’s industry intelligence and initiatives to catalyze corporate innovation that will radically transform the food system and deliver alternative protein products that compete on the key drivers of consumer choice: taste, price, and convenience.

Resource

State of the Industry Report: Plant-based meat, seafood, eggs, and dairy

This report details the commercial landscape, sales, investments, public funding, and innovation trends in the plant-based meat, seafood, egg, and dairy industry.

Support our work

Our industry engagement is made possible thanks to our generous, global family of donors. Philanthropic support is vital to our mission. Connect with us today to discuss how you can help fuel this transformative work.

Check out related resources

Consumer insights

Understand consumers, demographics, adoption, motivations, category descriptors, and opportunities for future research in alternative proteins.

Alternative protein company database

Explore the landscape of plant-based, cultivated, and fermentation companies including consumer brands, manufacturers, and ingredients companies.

Plant Protein Primer

Find information on nutrition, functionality, price, sourcing, and consumer perceptions of plant protein sources for plant-based meat.

Contact us

Have questions? Would you like to learn how to work with us? Get in touch!